Crypto liquidity – data and trends

What is crypto liquidity?

Liquidity is the ease with which you can exchange one asset for another. And liquidity in crypto – IT IS the ease with which we can exchange one cryptocurrency for another, including crypto representing traditional currencies, i.e., stablecoins.

We can measure liquidity in several ways:

- As volume

- and see how they compare to other assets

- And how it has changed over time

- How is liquidity on CEX vs. DEX

- As TVL – in DEXs

- Look at the absolute values and which stock exchanges have the most

- How has it changed over the last year

- As order book depth vs. TVL.

And show this statistic that Uniswap can be better than CEXy

These methods we will discuss in more detail in this article.

Sidenote. We are successfully delivering liquidity to many crypto projects. If you think your project could benefit from extending its presence on crypto exchanges, let us know. Here you will find the details on how we provide liquidity.

Crypto liquidity as a volume

The volume, i.e., the value of transactions that take place every day on a given asset, is a good metric showing the interest in a given asset, at the same time showing how much capital you can make transactions with. If we have a turnover of USD 100 million per day on a given cryptocurrency, we can be sure that the purchase or sale of this currency worth USD 1 million is unlikely to move its price strongly. In this sense, the volume represents liquidity.

An additional advantage of volume as a measure of liquidity is that it allows you to compare the liquidity of different assets with each other in absolute terms.

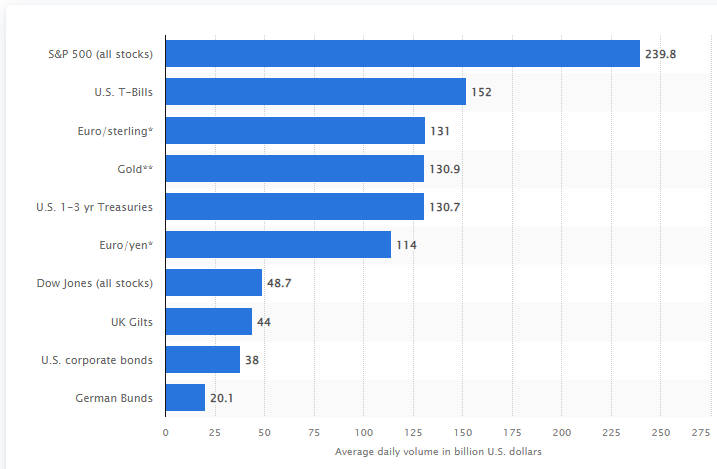

So what does the crypto volume look like compared to other assets?

In 2021-22, the daily volume of the entire crypto market was in the range of USD 50-100 billion, depending on whether we were dealing with a strong boom in 2021 or a bear market in 2022.

For comparison, the average daily turnover in 2021 for:

Source: Statista

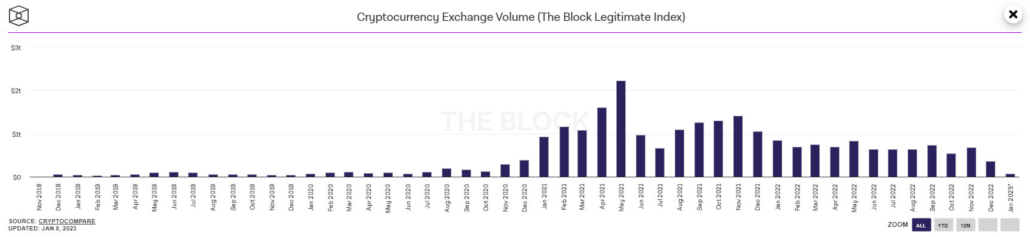

How has crypto volume changed over time?

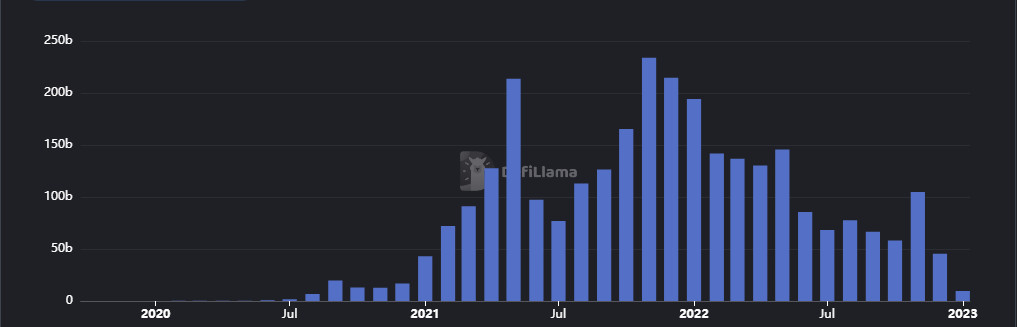

Source: The Block

The chart above illustrates how monthly volumes have developed in recent years. You can see how much has changed in 2021. Crypto has ceased to be a technological curiosity for a group of enthusiasts and has become a full-fledged alternative investment asset, also for the largest investment funds. The deep slump is not conducive to high investment activity, but this is a different market. High volumes will return as the macro situation changes to favor risky assets.

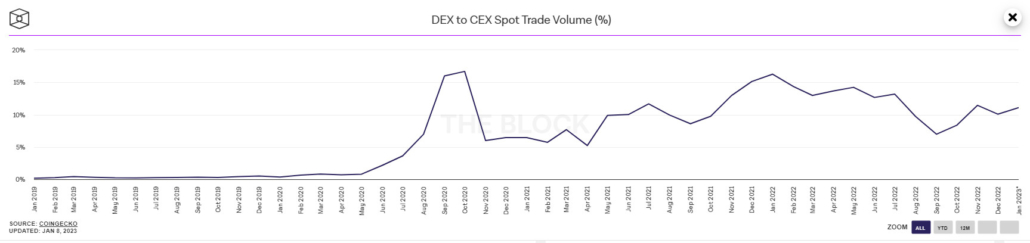

DEX to CEX trade volume

Which types of exchanges dominate in volume? As you might expect, still centralized. Volume on DEX is about one-fifth of what is on CEX. However, we expect that after the spectacular collapse of FTX, and several other well-known companies that operated in a centralized manner, this trend will be reversed.

Source: The Block

Source: DefiLlama

Above, you can see that the volume on DEXs fell more than on centralized exchanges, but you can also see the scale of the rebound in November.

The decrease in DEX volume was not as severe as all other metrics indicate, amounting to 8.2% from January to November 2022 compared to the same period in 2021. The most popular DEX is Uniswap, whose dominance continues to grow and has already reached almost 60% of the volume of all DEXs. In second place is PancakeSwap, but its importance has consistently decreased throughout the year.

Crypto liquidity as TVL

What is TVL

TVL or “Total Value Locked” is a metric used to measure the liquidity of a decentralized finance (DeFi) protocol. TVL is calculated by adding the value of all assets locked into the platform or protocol. These assets include cryptocurrencies and stablecoins. TVL is expressed as the dollar value of locked assets.

TVL is an essential issue for DeFi platforms and protocols because it can affect platform liquidity, which is the ease and cost with which users can buy or sell assets. A platform or protocol with a high TVL will have more assets available for trading, which can make it more attractive to users and increase liquidity.

TVL is often used as a benchmark for comparing the liquidity of DeFi protocols, as it provides a way to measure the total value of assets committed to a platform or protocol.

Change of TVL over time

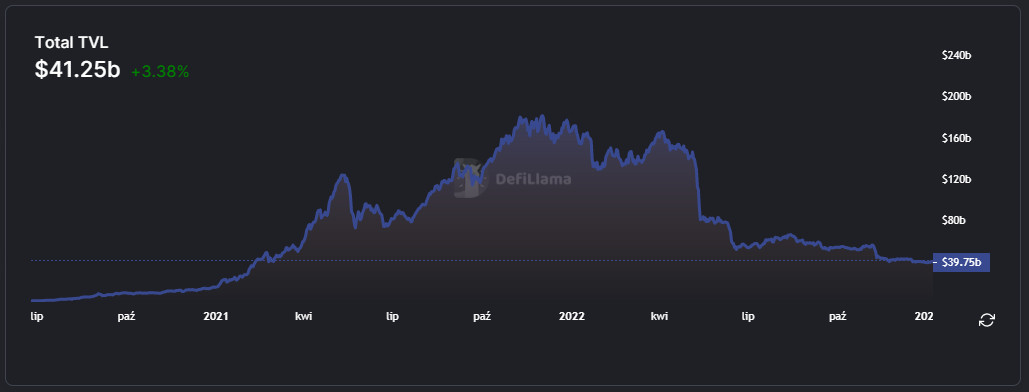

The TVL of the entire DeFi market shrunk in 2022 from $180 billion at its peak to $39 billion today.

Source: DefiLlama

The most drastic decline in TVL was recorded in May when Luna and UST collapsed. This has had a significant impact on the TVL of the Curve platform.

The overall decline in TVL is due to the decline in staking cryptos. If you look at the number of ethers staked on different platforms, it has only decreased slightly. This is another strong signal that can only be seen under the cover.

Source: DefiLlama

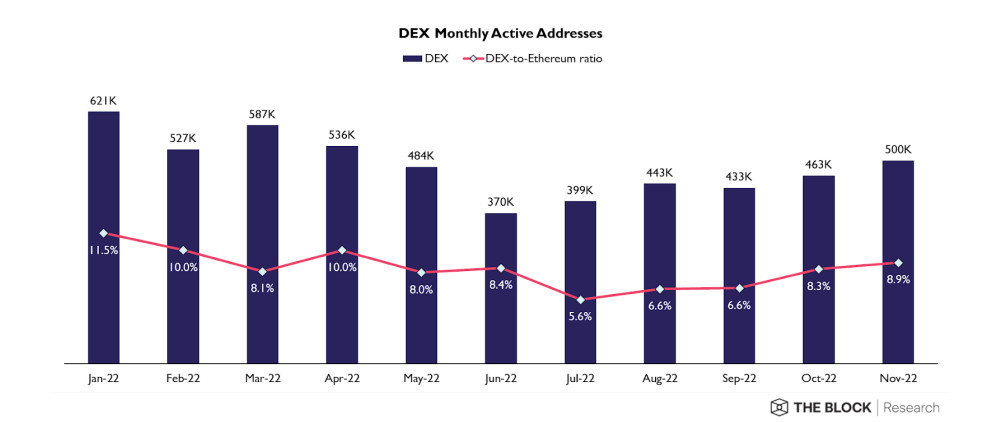

Source: The Block

A somewhat optimistic statistic for DEXs and the entire DeFi area is the number of active addresses that have been rebuilding for most of the year. The declines in TVLu and volumes are primarily due to the decline in crypto asset prices. Price trends will eventually reverse, and it is clear that the activity and interest of users in this form of investing is not decreasing.

AMMs remained the dominant DEX mechanism, with order book DEX volume accounting for less than 0.5% of total volume.

Crypto liquidity as a market depth

Market depth measures the number of stocks, contracts, or other units of a security or financial instrument available to buy or sell at a particular price level, often measured as a percentage of the distance from the midprice. This is, in our opinion, one of the most valuable measures of liquidity, as it shows how much liquidity is available to the trader if he were to immediately execute a trade of a specific size.

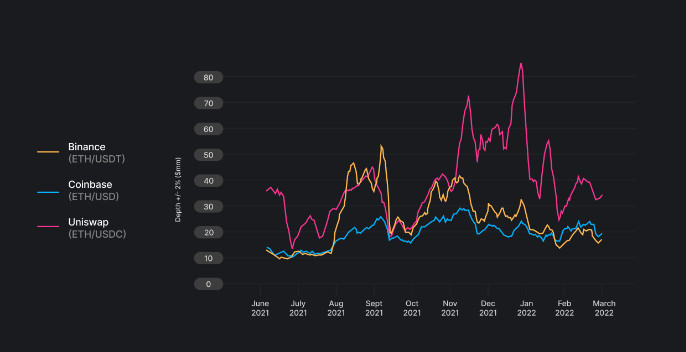

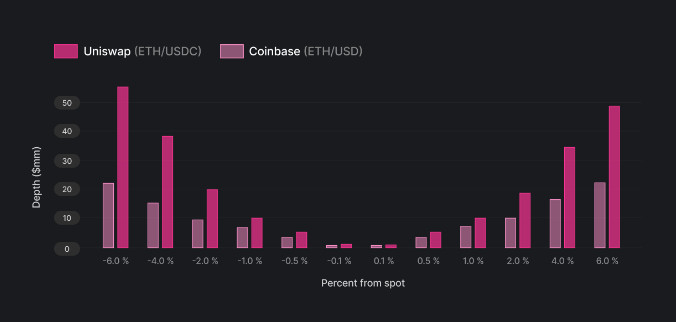

A fascinating study shows that for many essential instruments, Uniswap has a more outstanding market depth than the largest centralized exchanges.

Source: Uniswap

So on Uniswap, we can make transactions of 40 million, and we will not move the ETH price by more than 2%, while for Binance or Coinbase, it would be possible for an amount less than half.

Source: Uniswap

For larger transactions, Uniswap’s advantage grows even more. Similarly, for ETH-based pairs.

It seems that the mechanism of AMM and liquidity pools can be more effective than the traditional order book.

Sidenote. We are successfully delivering liquidity to many crypto projects. If you think your project could benefit from extending its presence on crypto exchanges, let us know. Here you will find the details on our market making services.

Author: Michal Rozanski, updated on 12 January 2023