Tokenomics – why should we care about this?

In this article, we aim to clarify these basic issues and explain the relationships between token supply and token price from the token’s perspective. Having a good understanding of these basic mechanisms can help avoid misinterpretation regarding the current status of the project.

The alphabet of tokenomics will help you to understand from a tokenomics perspective:

- Where the project is now?

- Where the project will be?

- How tokenomics will change, and what consequences it will have?

Check also how crypto market makers can help token projects

Market Cap and Fully Diluted Market Cap

The value of one token, i.e. its unit price, is affected by several factors. To fully understand these factors, we need to start with the basics. At the very beginning, it is necessary to be able to define the value of the project. Thanks to the Market Cap and Fully Diluted Market Cap, we can do so.

The Market Cap

The Market Cap equals the token’s price multiplied by the circulating supply, which is the number of tokens already released.

Market cap = price of the token x circulating supply

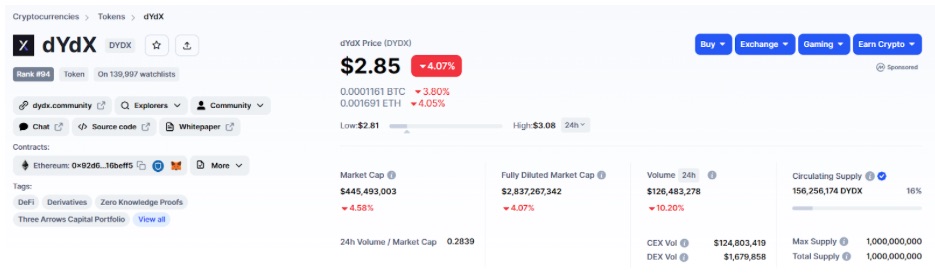

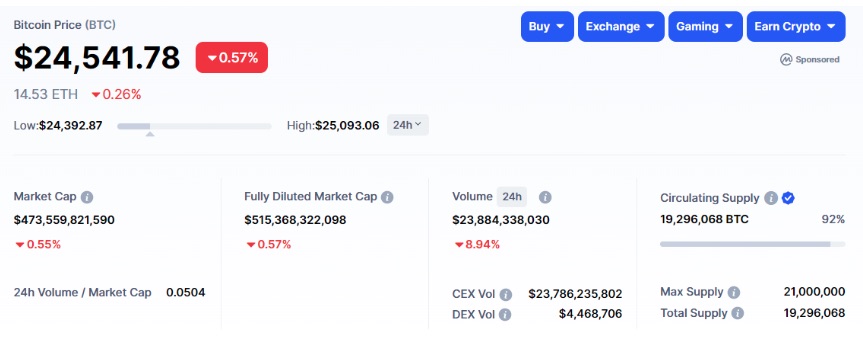

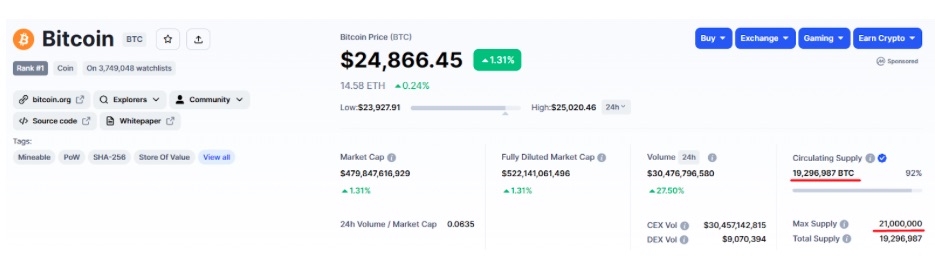

So, for example, market cap of bitcoin is equal to

Market cap of BTC = $24 541.78 x 19 296 068 = $473 559 821 590

Source: CoinMarketCap

The Fully Diluted Market Cap

The Fully Diluted Market Cap is calculated similarly to the Market Cap, but with one exception: instead of using the circulating supply, the maximum supply (all tokens which can be released in the contract) is taken into consideration.

Fully Diluted Market cap = price of the token x max supply

So for example Fully Diluted Market Cap of bitcoin is equal to:

Fully Diluted Market cap of BTC = $24 541.78 x 21 000 000 = $515 368 322 098

MC vs. FDV

Important! The Market Cap (MC) shows us the current valuation of the project. In contrast, the Fully Diluted Valuation (FDV) tells us about the valuation of the project when all tokens have been released into circulation. If there is a big gap between the Market Cap and FDV, it means that a still significant amount of tokens will be released to the supply! When that happens, can the project attract enough investors to keep the price at the same level or higher? If demand does not balance supply, it will reflect negatively on the unit price of the token.

For example, the Market Cap for the dYdX project is $445 million, while the FDV is $2.8 billion, resulting in a gap of approximately $2.35 billion. This means that if investment in dYdX today at the average price of $2.85, the dYdX team needs to attract around $2.35 billion in investments before all tokens are released, or the price will suffer and dropdown. The key question is whether the team will achieve this. To answer this question, it is necessary to know the speed of token release. Is it in 6 months or 5 years? It is more realistic to attract $2.35 billion of investments in 5 years than in 6 months. Questioning and understanding tokenomics allows us to predict the behavior of key project indicators like Market Cap or circulating supply ( we will discuss this in the next chapter).

Source: CoinMarketCap

Understanding the Market Cap and FDV is necessary to interpret the inflationary nature of the project correctly. The Market Cap of dYdX is currently 16% of the FDV, which means that if all tokens are released next year, the project needs to grow 6.25x just to keep the current price. Conversely, if the Market Cap of dYdX is 85% of the FDV, and all tokens are released next year, the project only needs to grow 1.17x to keep the current price. This demonstrates the power of understanding the Market Cap and FDV; these two metrics provide an instant overview of where the project is currently and how well it needs to perform to maintain at least a constant price level.

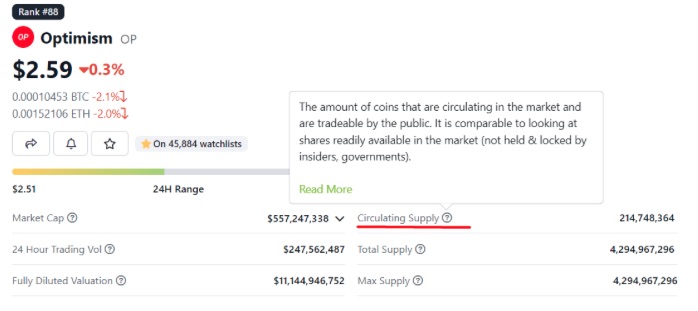

Circulating Supply and Max Token Supply

Another key factor is the circulating supply. The circulating supply defines how many tokens are currently released in the contract. In other words, it is the number of coins currently circulating in the market and are tradeable by the public. This is comparable to looking at the free float of shares available in the market and not held or locked by insiders or governments. On the other hand, the max token supply is the maximum amount of coins that will ever exist in the lifetime of the cryptocurrency. It is analogous to the fully diluted shares in the stock market. No more tokens can be released than the amount defined by the max token supply. You can easily subtract the circulating supply from the max supply to find out how many tokens will be released in the future. For example, for the bitcoin, it is:

Number of tokens to be released in the future = 21 000 000 – 19 296 987 = 1 703 987

Source: CoinMarketCap

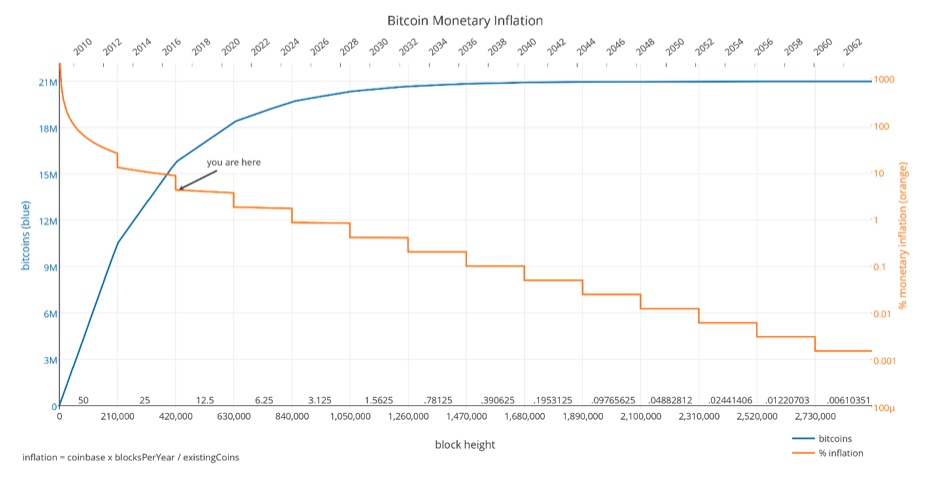

Yes, 1,703,987 Bitcoin can still be mined and released to the market. This is called inflation, and the release of additional tokens impacts the price. Assuming that the market cap of BTC will not change, the price will drop by 8% due to the release of an additional 8% of tokens to the market. Understanding how and when tokens will be released before making a financial decision is crucial. You can find this information in the whitepapers of every project. Bitcoin has a halving event approximately every 4 years, and its inflation rate is cut by half. You can study the chart below:

Source: CoinTelegraph

CoinMarketCap or CoinGecko are very useful sources to check the current circulating supply. Please be aware that the circulating supply on CoinGecko may be lower than it really is because it tries to subtract inactive tokens. Inactive tokens, according to Coingecko, are tokens that are staked or locked. Also, tokens that will be redeemed can be later sold on the market, which can drive the price lower.

Source: CoinGecko

Let’s dive into details

How circulating supply increases with BTC price was likely one of the easiest examples to understand. In reality, the tokenomics of a project can be far more complex. Nowadays, trends such as real yield and decentralized exchanges are very hot topics. I propose to examine dYdX and analyze what tokenomics can tell us about the project.

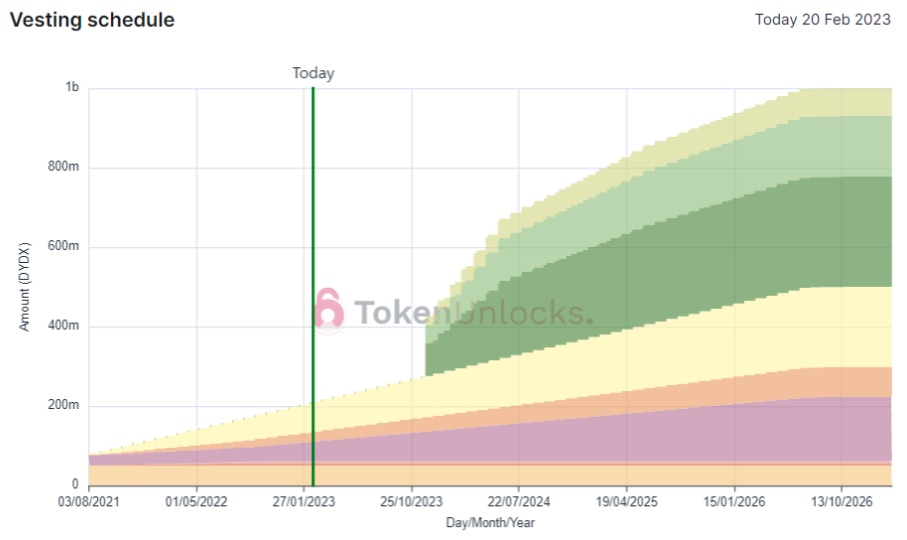

Every project needs funding before it can launch and operate. dYdX has raised a total of $87M in funding over four rounds, with their latest funding being raised on June 15, 2021, from a Series C round. Early investors were able to purchase tokens at a discounted price. All tokens have been divided into pools, as shown below.

Source: TokenUnlocks

$87M of investments is quite a significant amount of money. If we add up the tokens only from investors and dedicated pools, it appears that they own 50% of the tokens. According to the whitepaper, 30% of the tokens from the 50% total supply will be released. This means that 15% of the total supply will be unlocked in one day. As of today, dYdX’s market cap is $449,105,779, and with the release of the tokens, around $67M worth of tokens will be released within 24h! I would expect a price drop on December 1, 2023. Again inflation exceeds demand. It is crucial to understand where the project is and where it will be in the future. Also, it is worth reading carefully when every pool of tokens will be released. Sometimes, huge quantities of tokens from early investors are released from day one, while in others there is a cliff making public buyers safer for a defined period of time.

Source: TokenUnlocks

The vesting schedule visualizes how aggressively inflation is progressing. We can see where we are today and how rapidly the token supply will increase starting from December 1, 2023. The cliff for the investors makes a significant difference in how many tokens are released into the market at once, which can affect the token price.

Source:TokenUnlocks

Source: TokenUnlocks

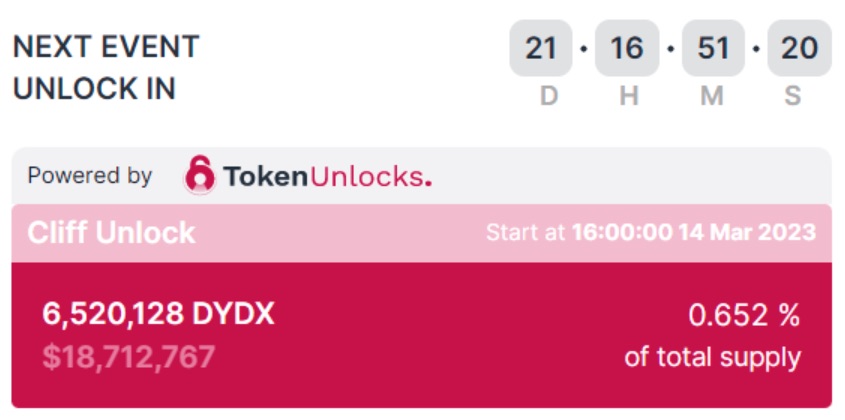

I recommend using the application TokenUnlocks to check the token unlock schedule for particular projects. This can give early information about token unlock and inform about the increase in token supply. The closest unlock for dYdX is in 21 days, but it is only 0.652% of the total supply, so I would not expect it to have a significant impact on the price.

Source: TokenUnlocks

Token inflation is a critical aspect of any project and should be studied carefully. A good understanding of tokenomics is a powerful and effective way to gain insight into the current and future status of the project. While not all definitions are covered in this article, understanding the ones mentioned can greatly improve market awareness.

Bottom Line

Thanks for your time! If you found this interesting, share the article on Twitter and show your friends that tokenomy is an important issue.

See you in the next article!

Check also for some useful insights on how to list your token.