Bittrex trading bot

About Bittrex:

Bittrex global is one of the well-known exchanges for digital assets. Bittrex Global aims for both institutional traders as well as individual or novice traders with a seamless experience for investing across cryptocurrencies. The Company is headquartered near the financial centre of Zurich, in the Principality of Liechtenstein.

Bittrex is built on top of a custom trading engine which was designed to provide scalability and to ensure that orders are executed fully and in real-time. Bittrex also supports third-party trading platforms and algorithmic trading via our extensive APIs.

Bittrex provides an automated monitoring platform that allows them to provide its users with fast transaction availability. This includes updates on balance, trade, and holding information.

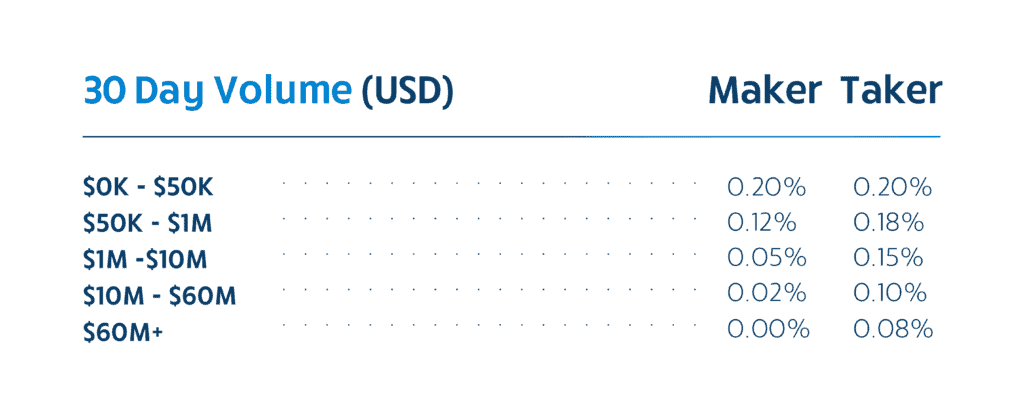

In regard to fees, Bittrex Global provides its customers with benefits from a fee schedule that offers lower rates as users trade more. Basically the more they trade, the more users will save.

Bittrex API:

Bittrex provides a comprehensive and powerful API consisting of REST endpoints for transactional operations and a complementary Websocket service providing streaming market and user data updates.

The Bittrex API facilitates call limits on all third-party endpoints to ensure the efficiency and availability of the platform for integrated users. Bittrex’s API users are allowed to make a maximum of 60 API calls per minute. Calls after the limit will not process (fails), with the limit resetting at the start of the next minute of the initial call

Bittrex enables corporate and high-volume accounts to contact customer support for additional information to ensure that they may continue operating at an optimal level.

As mentioned previously most of the order management is done through the REST API at Bittrex. Operation via the REST includes market order, limit order, ceiling order, Good-til-cancel order, immediate or cancel order, fill-or-kill, post-only and conditional orders.

The v3 WebSocket at Bittrex is developed to allow a client to subscribe to a live stream of updates about things that are changing in the system instead of needing to poll the REST API looking for updates. It is designed to complement and be used in conjunction with the v3 REST API. As such the messages sent from the socket include payloads that are formatted to match the corresponding data models from the v3 REST API.

Trading bots:

At Empirica, we have integrated our trading bots with Bittrex API, so that our customers can use it out of the box. Let’s name some trading bots that can be applied through API integration on Bittrex:

- Market Making bot: the service of quoting continuous passive trades prices to provide liquidity, and also be able to make some profits throughout this process.

- Arbitrage bot: takes advantage of small differences between markets. It is a trading activity that makes profits by exploiting the price differences of identical or similar financial instruments on different markets.

- Price mirroring bot: this bot uses liquidity and hedging possibilities from other markets to make the markets in a profitable way.

- Triangular Arbitrage bot: using this bot a trader could use the opportunity of exploiting the arbitrage opportunity from three different FX currencies or Cryptocurrencies.

- Basket Orders bot: with this bot, it is possible to execute trades on multiple coins at the same time with the possibility to hedge against other coins.

- VWAP bot: using this bot a trader can achieve the best price with large order by splitting it into multiple smaller ones throughout the trading day.

- Smart Order Routing bot: with this bot, the trader can find the best price for your order on all crypto exchanges and execute it.

In case you would need help from professional software developers to help you build proprietary trading bots and integrate it with the API of Bittrex or other crypto exchanges, you can consult with our quant team.

Have you implemented other trading bots?

We have implemented following bots and algorithms: