Bitget listing – and why you need a market maker to help you manage your liquidity there

Facts about Biget exchange

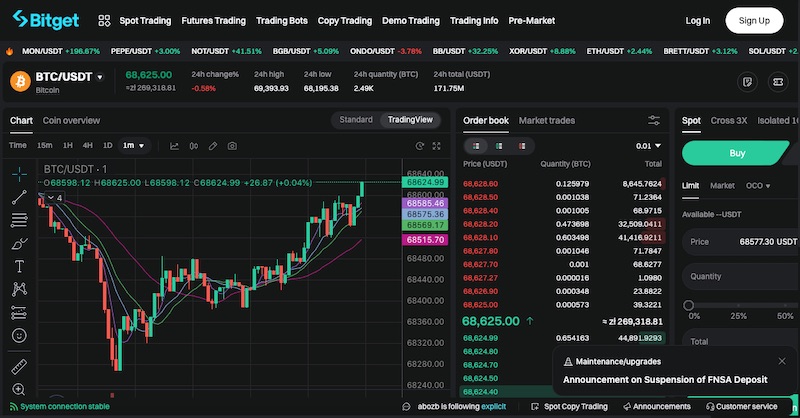

Bitget is a centralized cryptocurrency exchange established in 2018 and is registered in Seychelles. Bitget is one of the leading crypto exchanges with over 20 million users across 100 countries. The exchange has already established regional hubs in Asia and LATAM markets and plans to expand its global presence by setting up more regional hubs in Europe and Africa regions.

Bitget is ranked among the top 15 crypto exchanges in the world, according to CoinGecko ( ranked 14.) and CoinMarketCap (ranked 12.).

Why list on Bitget

Bitget’s declared user base (20M+) allows projects to attract the attention of many crypto investors.

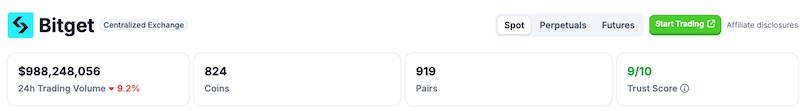

At the moment of writing the article (May 2024), according to CoinGecko, there are 824 coins and 919 trading pairs available on the exchange.

Bitget’s score metrics

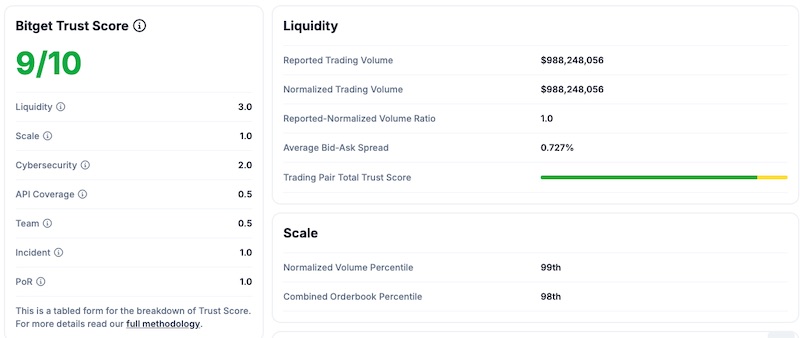

When choosing a venue for listing, it is important to check its reputation and general rank in comparison to other exchanges. A good choice is to check how CoinGecko, CoinMarketCap and Nomics rate the exchange.

CoinGecko uses Trust Score, a rating algorithm evaluating the legitimacy of an exchange’s trading volume. Trust Score is calculated on a range of metrics such as liquidity, scale of operations, cybersecurity score, and more. Bitget’s Trust Score is 9, which is very high. Only 24 exchanges have such a score on CoinGecko.

CoinMarketCap’s Exchange Score is based on the following factors:

- Web Traffic

- Average Liquidity & Volume

- the Confidence that the volume reported by an exchange is legitimate. Weights are assigned to the above-mentioned factors and a score from 0.0 to 10.0 is given to the Spot Exchange.

Bitget’s Exchange Score is 6.7.

What is the cost of listing a token on Bitget?

Bitget, as most exchanges do, is not officially disclosing listing fees. Why? There are a few reasons, like compliance, NDAs and of course negotiation process, which they adjust to the situation of the token. You can count on us in this process on most of crypto exchanges.

Our services include extensive support in the following areas:

- Introducing to verified listing teams. Prevent listing scams by verifying listing managers and communication channels.

- Assist in the listing negotiation process in regard to price and KPIs.

- Ensuring both initial and long-term liquidity for the listed token, fulfilling the exchange’s KPIs.

- Stabilizing prices across CEX and DEX platforms

Contact us and let’s talk about the details.

Why Empirica?

Listing is more than just negotiating fees with an exchange and successful listings require active involvement of a market maker. We know how to go through this process smoothly.

An example of a successful token listing that we supported on three exchanges as the only market maker

We are partnering with a web3 gaming startup that introduced a product with solid fundamentals and a clear use case. We supported token debuts on chosen centralized exchanges by providing initial deep liquidity for substantial trades from the first seconds it went public. Our role was to support token debut on three centralized exchanges as the only market maker responsible for listings.

The price increased up to 250% within the first week after listing, and remains stable after the first month. Since the listing, volumes have begun to rise significantly, reflecting a healthy market and good trading conditions (see the Price and Volume chart).