Facts about Kraken exchange

Kraken was founded in 2011 and launched in September 2013. Today it is one of the major centralized cryptocurrency exchanges in the world. According to the information provided by Coingecko, as of September 2022, Kraken is the 8th largest crypto exchange based on daily trading volume. On the official website of the platform, it is revealed that today, investors and traders who prefer this US-registered platform can get access to 90+ coins and over 200 pairs.

The Kraken team unites two thousand employees who are based in 60 countries. Around 90% of them work remotely as Kraken believes this business model makes people happy.

Listing on Kraken

Kraken is known as a very reliable and well-trusted crypto exchange that attracts the attention of wide circles of traders from different corners of the world. The platform has a team that is responsible for researching token projects which can be approved for listing.

If your project has its own coin and you are interested in offering your token to Kraken users, you can contact the platform’s team via email and provide all the details of your project for review. The team asks to make the description as detailed as possible for conducting a proper analysis.

At the moment, the platform offers 211 coins that are available in 658 pairs.

Kraken’s score metrics

When choosing a venue for listing, it is essential to check its reputation and general rank in comparison to other exchanges. A good choice is to check how CoinGecko, CoinMarketCap, and Nomics rate the exchange.

CoinGecko uses Trust Score, a rating algorithm evaluating the legitimacy of an exchange’s trading volume. Trust Score is calculated on a range of metrics such as liquidity, the scale of operations, cybersecurity score, and more. Kraken’s Trust Score is 10. Only 10 exchanges out of more than 500 cryptocurrency platforms have a Trust Score of 10.

CoinMarketCap’s Exchange Score is based on the following factors:

- Web Traffic

- Average Liquidity & Volume

- the Confidence that the volume reported by an exchange is legitimate. Weights are assigned to the above-mentioned factors and a score from 0.0 to 10.0 is given to the Spot Exchange.

Kraken’s Exchange Score is a high 7.8.

Nomics’ metric is called Impact Score – and represents an exchange’s influence on the price of cryptocurrencies it trades. The score is a combination of web traffic, volume, and other factors.

Kraken’s Impact Score is 7.69.

The second Nomics metric, called Transparency Rating is A (full transparency). Nomics explains the purpose of these scores as rating cryptocurrency exchanges by their willingness to provide auditable history.

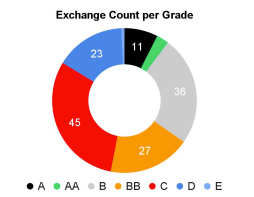

CryptoCompare has established the notion of Top-Tier volume whereby investors can segment the market into higher and lower-risk volumes (A is the best and E is the worst grade).

Here’s the current CyptoCompare’s classification of Kraken in comparison with other exchanges:

Listing requirements

When you apply for a listing on centralized exchanges, the legal team will examine your documentation, which usually includes the certificate of incorporation, legal id of team members, whitepaper, etc. In certain cases (like stable coins), they may require additional documents. You will be asked to provide key information about your token, team, and community. This information should persuade the exchange team that your token will be successful after listing. Take the time to do it well.

The project review consists of several key points:

- Project Introduction: The token issuer should write a short summary of what the project does or fill out a form providing necessary project details and information for review by the exchange’s team.

- Token Overview: This includes chain type (BSC, ERC, TRC, etc.), blockchain explorer, smart contract address, use of token, etc.

- Token Economics and Fundraising: You will be asked to provide information about token distribution, token unlock schedule, or conducted token sales.

- Marketing Strategy and Community: To check the user engagement and quality of business partnerships, the exchange will check community hubs with their main geographies. They check the website, Twitter, and Telegram channels, including the number of followers and likes per post. Projects should also introduce strategic partnerships with expected results.

- Project Team: Introduce your team members with bio descriptions of the Founder/CEO and core members, including Linkedin profile links..

- Listing Plan: Outline your plan for listing the token. If it’s not your debut, you’ll need to provide the exchange team with information on your existing markets and trading volumes on them.

- Market Maker: You must specify a market maker who works with you and provides initial liquidity during the listing.

By addressing these points thoroughly, you increase the probability of the approval and entry into negotiations.

We help token projects get listed on Kraken. We can introduce you to their listing team and verify the communication channels to protect you against scams. We also can help you in the negotiation process and ensure liquidity for your token at the very first moment of your listing. You can specify Empirica as your market maker – that could be an extra point for you :)

Contact us to learn how to increase your chances of a successful listing on Kraken.

What is the cost of listing a token on Kraken?

Most exchanges do not officially disclose listing fees, which can vary widely across different spots. Sometimes, exchanges may not charge anything for listing, while other times the fees can be substantial, with no upper limit. These amounts are always under NDA, so you probably will not find any credible information on them across the websites.

We can provide you with an overview of the listing costs on various exchanges based on our experience. Schedule a free consultation. We can discuss the best listing strategy for your token. You can consider our help in the fee negotiation process. As we have helped many project to get listed on Kraken, you can count on us in this process.

Our services include extensive support in the following areas:

- Introducing to verified listing teams. Prevent listing scams by verifying listing managers and communication channels.

- Assist in the listing negotiation process in regard to price and KPIs.

- Ensuring both initial and long-term liquidity for the listed token, fulfilling the exchange’s KPIs.

- Stabilizing prices across CEX and DEX platforms

Contact us and let’s talk about the details.

Listing on Kraken with our help

We can help you prepare for listing your token and managing liquidity on Kraken and other exchanges. The usual process looks like this:

- We set up a call to understand the phase of your project. The following points will be discussed:

- Are you already listed on DEXes or CEXes?

- What is the tokenomy of your project?

- Do you have a listing strategy for your token?

- We discuss the best possible liquidity strategy for your project.

- If we agree to set up a partnership, we introduce you to verified managers of one or more exchanges (listing support).

- After your project gets listed on an exchange, we help you build your markets on platforms.

Why do I need a market maker?

Managing a token startup is a real challenge. As a cryptocurrency project, you need to focus on building your products and services and leave liquidity to market makers.

A market maker will help you:

- deepen the liquidity on your token’s books and make them more stable – which helps mitigate the price fluctuations of your coin

- lower spreads between bids and asks so that the prices get fairer for investors; that reduces the cost of entering and exiting positions and encourages investors to trade your coin

In the 24/7 cryptocurrency markets, well-managed assets are supported by algorithmic market makers. They provide liquidity through market-making services, supported by fully automated software algorithms. Empirica’s liquidity products are reputable top-notch algorithmic market-making solutions.

SCHEDULE AN APPOINTMENT WITH US TO DISCUSS THE LISTINGS AND BUILDING THE LIQUIDITY OF YOUR MARKETS

FAQ

WHERE IS KRAKEN LOCATED?

Kraken is registered in San Francisco, US.

WHAT IS KRAKEN’S DAILY TRADING VOLUME?

According to Coingecko, as of September 30, 2022, the 24h volume on Kraken was around $557 million.

IN WHAT COUNTRIES IS KRAKEN AVAILABLE?

The platform is available to all residents of the US, except for traders who are based in Washington and New York. In general, the exchange provides its services to users in around 200 countries. The exceptions are such countries as Afghanistan, Central African Republic, Congo-Brazzaville, Eritrea, Congo-Kinshasa, Guinea-Bissau, Cuba, Lebanon, Iran, Mali, Iraq, Namibia, Libya, Somalia, North Korea, South Sudan, Syria, Sudan, Tajikistan, and Yemen.

WHAT IS A CENTRALIZED EXCHANGE (CEX)?

It is a digital asset marketplace using a similar business model to traditional asset platforms like stock exchanges.

Centralized crypto venues typically keep limit order books, which are lists of open buy and sell orders, consisting of volumes and prices. They match up buyers and sellers and announce current market prices based on the last price an asset sells for.

WHAT IS TOKEN LIQUIDITY?

This term refers to the ease with which tokens can be swapped for other cryptocurrencies (other crypto assets or government-issued fiat currencies).

WHO ARE MARKET MAKERS?

A market maker is a company or individual that regularly buys and sells financial assets at a publicly quoted price to provide liquidity to the financial or digital asset markets. Their role is to satisfy market demand. Market making is also used as a profit generation trading strategy by hedge funds.

WHAT ARE THE BEST EXCHANGES TO BE LISTED ON?

Please check our related articles: listing on uniswap, listing on binance, listing on bitmart, listing on bitfinex, bitkub listing, listing on bitso, listing on btcturk, listing on bitvavo, listing on kucoin, listing on mexc, listing on kraken, Crypto.com listing, listing on bitpanda, listing on BingX, listing on zonda, listing on pancakeswap, and Coinbase listing.