Facts about BtcTurk exchange

Being established in 2013, BtcTurk became the 1st crypto exchange in Turkey. After rebranding, the exchange is known as BtcTurk Pro. The platform is registered with the Istanbul Chamber of Commerce.

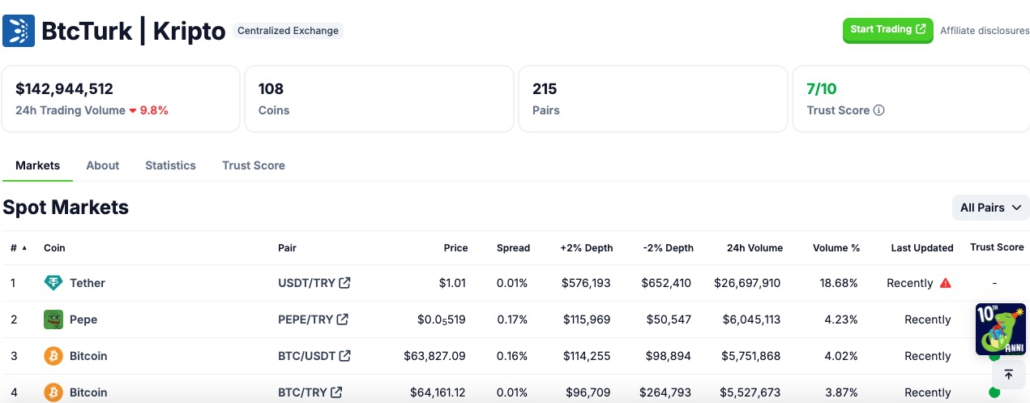

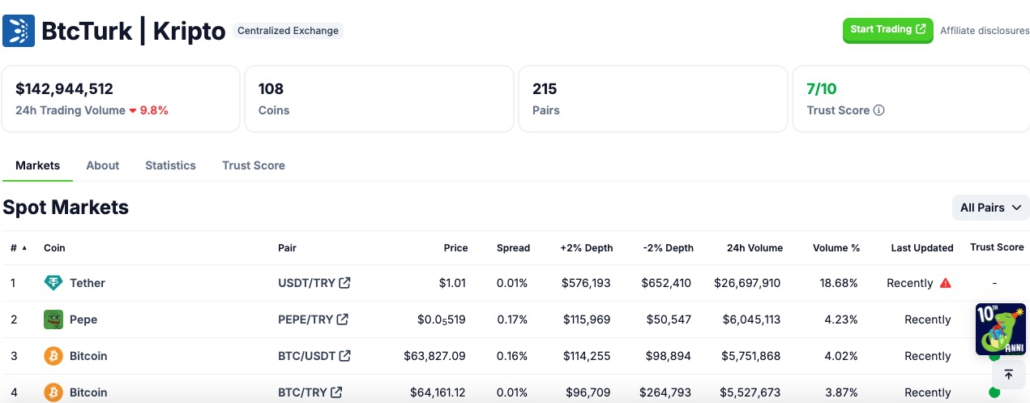

According to CoinGecko, at the time of writing (April 2024), this centralized cryptocurrency exchange provides its users with access to 106 coins and 215 trading pairs.

Why list on BtcTurk

BtcTurk is one of the best exchanges in Europe in terms of organic investors seeking to trade with each other. It is a great platform to list your token on. However, BtcTurk is still catching up with the listing on the TOP 100 coins, so it is not easy to approach them and gain attention with your startup token.

BtcTurk’s score metrics

When choosing a venue for listing, it is important to check its reputation and general rank in comparison to other exchanges. A good choice is to check how CoinGecko, CoinMarketCap and Nomics rate the exchange.

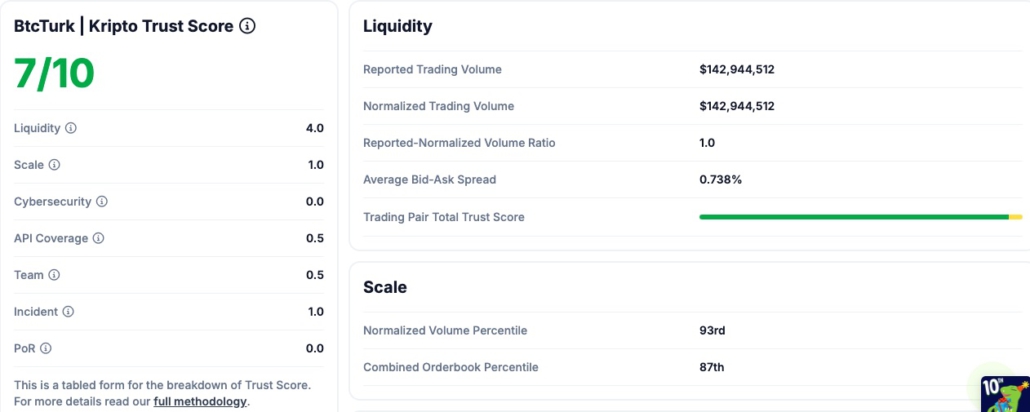

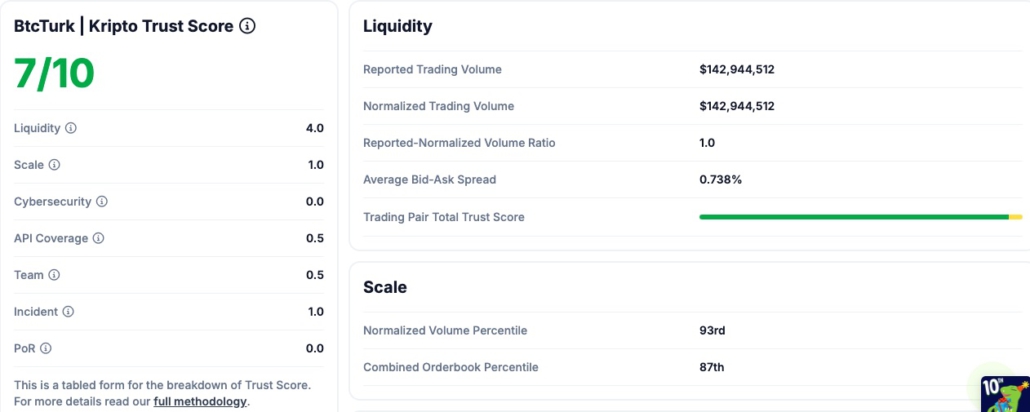

CoinGecko uses Trust Score, a rating algorithm evaluating the legitimacy of an exchange’s trading volume. Trust Score is calculated on a range of metrics such as liquidity, scale of operations, cybersecurity score, and more. BtcTurk’s Trust Score is 7.

CoinMarketCap’s Exchange Score is based on the following factors:

- Web Traffic

- Average Liquidity & Volume

- the Confidence that the volume reported by an exchange is legitimate. Weights are assigned to the above-mentioned factors and a score from 0.0 to 10.0 is given to the Spot Exchange.

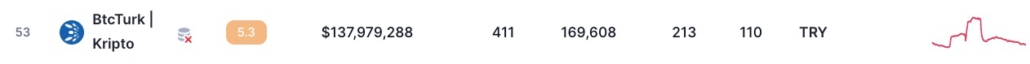

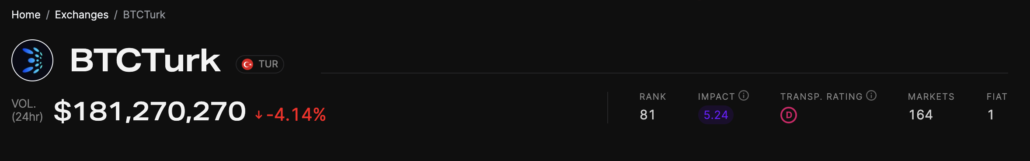

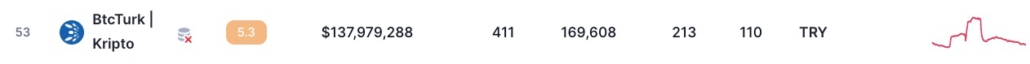

BtcTurk’s Exchange Score is 5.3

Nomics’ metric is called Impact Score – and represents an exchange’s influence on the price of assets it trades. The score is a combination of web traffic, volume, and other factors.

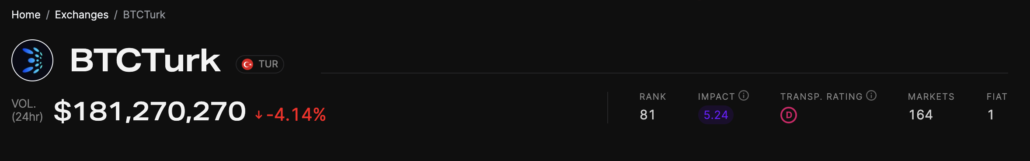

BtcTurk’s Impact Score is 5.24.

Listing requirements

When you apply for a listing on centralized exchanges, the legal team will examine your documentation, which usually includes the certificate of incorporation, legal id of team members, whitepaper, etc. In certain cases (like stable coins), they may require additional documents. You will be asked to provide key information about your token, team, and community. This information should persuade the exchange team that your token will be successful after listing. Take the time to do it well.

The project review consists of several key points:

- Project Introduction: The token issuer should write a short summary of what the project does or fill out a form providing necessary project details and information for review by the exchange’s team.

- Token Overview: This includes chain type (BSC, ERC, TRC, etc.), blockchain explorer, smart contract address, use of token, etc.

- Token Economics and Fundraising: You will be asked to provide information about token distribution, token unlock schedule, or conducted token sales.

- Marketing Strategy and Community: To check the user engagement and quality of business partnerships, the exchange will check community hubs with their main geographies. They check the website, Twitter, and Telegram channels, including the number of followers and likes per post. Projects should also introduce strategic partnerships with expected results.

- Project Team: Introduce your team members with bio descriptions of the Founder/CEO and core members, including Linkedin profile links..

- Listing Plan: Outline your plan for listing the token. If it’s not your debut, you’ll need to provide the exchange team with information on your existing markets and trading volumes on them.

- Market Maker: You must specify a market maker who works with you and provides initial liquidity during the listing.

By addressing these points thoroughly, you increase the probability of the approval and entry into negotiations.

We help token projects get listed on BtcTurk. We can introduce you to their listing team and verify the communication channels to protect you against scams. We also can help you in the negotiation process and ensure liquidity for your token at the very first moment of your listing.

Contact us to learn how to increase your chances of a successful listing on BtcTurk.

Listing fee

Most exchanges do not officially disclose listing fees, which can vary widely across different spots. Sometimes, exchanges may not charge anything for listing, while other times the fees can be substantial, with no upper limit. These amounts are always under NDA, so you probably will not find any credible information on them across the websites.

We can provide you with an overview of the listing costs on various exchanges based on our experience. Schedule a free consultation. We can discuss the best listing strategy for your token. You can consider our help in the fee negotiation process. As we have help many projects to get listed on BtcTurk you can count on us in this process.

Listing on BTCTurk with our help

We can support you in listing your token and managing liquidity on BtcTurk and other exchanges. The usual process looks like this:

- We set up a call to understand the phase of your project. The following points will be discussed:

- Are you already listed on DEXes or CEXes?

- What is the tokenomy of your project?

- Do you have a listing strategy for your token?

- We discuss the best possible liquidity strategy for your project.

- If we agree to set up a partnership, we introduce you to verified managers of one or more exchanges (listing support).

- After your project gets listed on an exchange, we help you build your markets on platforms.

Why do I need a market maker?

Managing a token startup is a real challenge. As a cryptocurrency project, you need to focus on building your products and services and leave liquidity to market makers.

A market maker will help you:

- deepen the liquidity on your token’s books and make them more stable – which helps mitigate the price fluctuations of your coin

- lower spreads between bids and asks so that the prices get fairer for investors; that reduces the cost of entering and exiting positions and encourages investors to trade your coin

In the 24/7 cryptocurrency markets, well-managed assets are supported by algorithmic market makers. They provide liquidity through their market-making services, supported by fully automated software algorithms. Empirica’s liquidity products are reputable top-notch algorithmic market making solutions.