Algorithmic crypto trading: market specifics and strategy development

By Marek Koza, Product Owner of Empirica’s Algo Trading Platform

Among trading professionals, interest in cryptocurrency trading is steadily growing. At Empirica, we see it by an increasing number of requests from trading companies, commonly associated with traditional markets, seeking algorithmic solutions for cryptocurrency trading or developing trading software with us from scratch. However, new crypto markets suffer from old and well-known problems. In this article, I try to indicate the main differences between traditional and crypto markets and take a closer look at a few algorithmic strategies (known as trading bots on crypto markets) that are currently effective in the crypto space. Differences between crypto and traditional markets constitute an exciting and deep subject in itself, which is evolving quickly as

the pace of change in crypto is also quite fast. But here I only want to focus on algorithmic trading perspectives.

LEGISLATION

First, there is a lack of regulations in terms of algorithmic usage. Creating DMA algorithms on traditional markets requires a great deal of additional work to meet reporting and measure standards as well as limitations rules provided by regulators (e.g., EU MiFIDII or US RegAT). In most countries, crypto exchanges have yet to be covered by legal restrictions. Nevertheless, exchanges provide their own internal rules and technical limitations, which, in a significant way, restrict the possibility of algorithmic use, especially in the HFT field. This is crucial for market-making activities, which now require separate deals with trading venues.

DERIVATIVES

As for market-making, we should notice an almost non-existent derivatives market in the crypto world. Even if a few exchanges offer futures and options, they only apply to a few of the most popular cryptocurrencies. Combining it with highly limited margin trading possibilities and none of the index derivatives (contracts that reflect market pricing), we see that many hedging strategies are almost impossible to execute and may only exist as a form of spot arbitrage.

As for market-making, we should notice an almost non-existent derivatives market in the cryptoworld. Even if a few exchanges offer futures and options, they only apply to a few popular cryptocurrencies. Combining it with highly limited margin trading possibilities and none of the index derivatives (contracts that reflect market pricing), we see that many hedging strategies are almost impossible to execute and may only exist as a form of spot arbitrage.

DECENTRALIZATION

The above-mentioned facts are slightly compensated for by the biggest advantage of blockchain currencies – fast and direct transfers around the world without banks intermediation. With cryptoexchange APIs mostly allowing automation of withdrawal requests, it opens up new possibilities for algorithmic asset allocation by much smaller firms than the biggest investment banks. This is important due to two things. Firstly, there is still no one-stop market brokerage solution we know from traditional markets. Secondly, cryptocurrency trading is distributed among many exchanges around the world. It could therefore be tricky for liquidity seekers and heavy volume execution. It implies there is still much to do for execution algorithms, such as smart order routing.

CONNECTIVITY

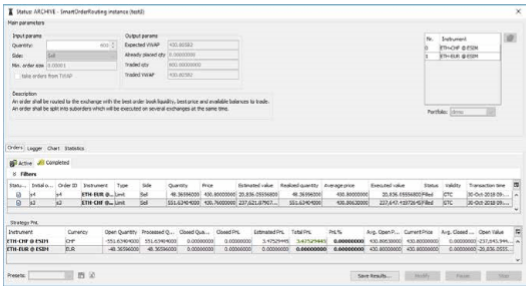

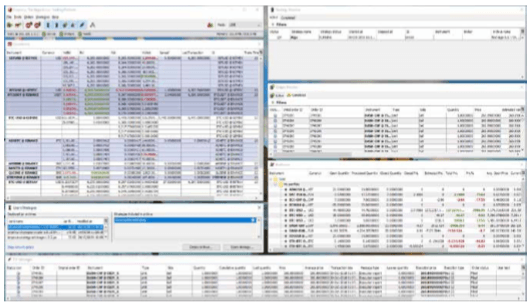

A smart order routing strategy GUI

Another difference is direct market access for algorithmic trading. While on traditional markets, DMA is costly, cryptocurrency exchange systems provide open APIs for all their customers that may be used without upfront prerequisites. Although adopted protocols are usually easy to implement, they are often too simplistic. They do not usually offer advanced order types. Besides, the order life-cycle status following is cumbersome and trading protocols differ among exchanges since each one requires its own implementation logic. That makes a costly technical difference compared to traditional markets with common standards, including FIX protocol.

MARKET DATA

Fast, precise and up-to-date data are crucial from an algorithmic trading perspective. When a trader develops algorithms for cryptocurrencies, she should be aware of a few differences. APIs provided by crypto exchanges give easy access to time & sales or level II market data for everyone for free. Unfortunately, data protocols used in the crypto space are unreliable, and trading venue systems often introduce glitches and disconnections. Moreover, not every exchange supports automatic updates and an algorithm has to issue a request every time it needs to check on the state of a market, which is difficult to reconcile with algorithmic strategies.

The APIs of most exchanges allow downloading of historical time & sale data, which is important in the algorithmic developing process. However, historical level II data are not offered by exchanges. We should also notice that despite being immature, the systems of crypto trading venues are evolving and becoming more and more professional. This forces trading systems to follow and adapt to these changes, which adds big costs to systems’ maintenance. In the following sections I overview a few trading algorithms that are currently popular among crypto algo traders because of the differences between traditional and crypto markets listed above.

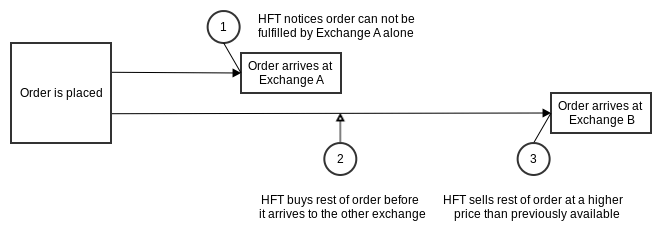

SMART ORDER ROUTING

Liquidity is, and probably will remain, one of the biggest challenges for cryptocurrency trading. Trading on bitcoin and Ethereum, and all other altcoins with smaller market capitalization, is split among over 200 different exchanges. Executing a larger volume of assets often requires seeking liquidity in more than one trading venue. To achieve that, cryptocurrency traders may apply smart order routing strategies. These follow limit order books for the same instrument from different exchanges and aggregate them internally. When an investment decision is made, the strategy splits the order among exchanges that offer the best prices for the instrument. A well-designed strategy will also manage partially filled orders left in the order book in case some volume disappears before the order has arrived at the market. This strategy could be combined with other execution strategies such as TWAP or VWAP.

Empirica algorithmic trading platform front-end app (TradePad) for crypto-markets.

ARBITRAGE

The days when simple cross-exchange arbitrage was profitable with manual execution are over. Nowadays, price differences among exchanges for the most actively trading crypto assets are much smaller than a year ago and transactional and transfer costs (especially for fiat) still remain at a high level. Trading professionals are now focused on using more sophisticated arbitrage algorithms such as maker-taker or triangular arbitrage. The former works by quoting a buy order on one exchange, based on VWAP, for a particular amount of volume from another exchange (the same instrument) decreased by expected fees and return. A strategy is actively moving quoted order and if the passive gets executed, it sends a closing order to the other exchange. As the arbitrage is looking for bid-bid and ask-ask difference and maker fees are often lower, this type of arbitrage strategy is more cost-effective.

Triangular arbitrage may be executed on a single exchange because it looks for differences among three currency pairs that are connected to each other. To illustrate, let us use this strategy with BTCUSD, ETHUSD, and ETHBTC pairs. This strategy keeps following order books of these three instruments. The goal is to find the inefficient quoting and execute trades on three instruments simultaneously. To understand this process, we should notice that the ratio between BTCUSD and ETHBTC should reflect the ETHUSD market rate. Contrary to some FX crosses, all cryptocurrency pairs are priced independently. This creates numerous possibilities for using triangular arbitrage in the crypto space.

MARKET MAKING

Market making should be considered more as a type of business than as just a strategy. The main task of a market maker is to provide liquidity to markets by maintaining bid and ask orders to allow other market participants to trade any time they need. Since narrow spreads and adequate prices are among the biggest

factors of the exchange’s attractiveness, market making services are in high demand. On the one hand, crypto exchanges have special offers for liquidity providers, but on the other hand, they require from new coins issuers a market maker before they start listing an altcoin.

These agreements are usually one source of market maker income. Another one is a spread – a difference between a buy and a sell price provided to the other traders. The activity of a market maker is related to some risks. One of them is inventory imbalance – if a market maker buys much more than sells or sells much more than buys, she stays with an open long or short position and takes portfolio risk, especially in volatile crypto markets. This situation may happen in markets with a strong bias or when market maker is quoting wrong or delayed prices, which arbitrageurs will immediately exploit. To avoid such situations, market makers apply algorithmic solutions such as different types of fair price calculations, trade-outs, hedging, trend, and order-flow predictions, etc. Technology and math used in market making algorithms are exciting subjects for future articles.

SUMMARY

Fast-developing crypto markets are attracting many participants, including more and more trading professionals from traditional markets. However, the crypto space has its own specificity, such as high decentralization, maturing technology, and market structure. Compared to other markets, these differences make some strategies more useful and profitable than others. Arbitrage – even simple cross-exchange is still very popular. Market making services are in high demand. Midsized and large orders involve execution algorithms like smart order routing. To embrace the fast-changing crypto environment, one needs algorithmic trading systems with an open architecture that evolves alongside the market.