Articles about new events in crypto, including press releases about new products and projects.

Empirica among innovative companies at the Trading CEE conference

The “Trading CEE: Equities and Derivatives” conference is one of the most important financial industry related events in Central and Eastern Europe. The co-organizers of the event were the Warsaw Stock Exchange, the Global Investor Group and the National Depository for Securities. Michał Różański, CEO of Empirica took part in a panel devoted to the future of the fintech industry.

The Trading CEE was held in Warsaw’s Hilton hotel, where several hundred capital markets experts had the opportunity to talk about such important issues as the Mifid II regulation, or the scale of the fintech revolution in Poland and internationally.

They also discussed the decision made recently by FTSE Russell (the supplier of indices belonging to the London Stock Exchange group) to change the status of Poland from that of an Emerging Market into that of a Developed Market and considered the significance of this shift for the national economy.

Among many of the excellent speakers, we had the change to listen to Marek Dietl, President of the Warsaw Stock Exchange and Toby Webb, Head of EMEA Information Services FTSE Russell. The inaugural panel on the opportunities and threats facing investment markets in our region gathered such experts as Ales Ipavec, head of the stock exchange in Ljubljana, Richard Vegh from the Budapest Stock Exchange, Ivan Takev, head of the Bulgarian Stock Exchange and Head of International Sales of the Moscow Stock Exchange Tom O ‘ Brien.

Fintech Innovation Forum

The panel regarding the fintech industry was very popular among visitors, especially the topic of the development of tools based on artificial intelligence and their impact on investment markets in Poland. It was organized in such a way as to allow for 4 of the most promising Central & Eastern European companies in the modern financial technologies industry to present what they offer. One of the main participants of this part of the Trading CEE conference was Michał Różański, CEO and founder of Empirica, the fintech software house.

During his speech, he focused mainly on the presentation of innovations in the field of robo-advisors, which are already revolutionizing the global investment market.

– The robo-advisor platform is not only the future, but the present of wealth and asset management. Our Empirica Robo Advisor service stands out in the international market above all through its very high level of support for advisors in their work with the service’s users. All this is thanks to solutions in the field of AI analytics, which allows them to receive a full picture of the actions taken in the user profile and to quickly respond if these actions threaten the assets, which in the end also reduces the risk of losing the customer. Another important element of our consulting service is the fact that we have built it based on the strong foundations of our platform for Algo Trading. Thanks to it, our robo-solution has fully automated access to the data stream coming from the most important financial institutions at every stage of the Empirica Robo Advisor process. – explains Michał Różański.

New generation of users

Platforms from the robo-advisor category not only democratize investment opportunities, but also reduce the price of consultancy services. In an era of technological revolution, a millennial generation is slowly entering the capital market- people accustomed to continuous presence in the online world. Advisory platforms will enable it for them. Friendly user interfaces, notifications that they know from social media and an automated transaction system based on a personalized portfolio are already present in the fintech area. However, in order for these tools to function in such a complicated environment as the financial market, powerful computational engines based on artificial intelligence (AI) must be behind them. Empirica helps financial companies enter this world by providing an advisory platform that automates the asset management processes and is based on innovative solutions in the field of data processing. – adds the CEO of Empirica.

Empirica is a Wrocław-based company that offers solutions such as an Algo Trading Software implemented by major institutional investors in Poland, market makers software, wealth management system framework, cryptocurrency trading bots and trading software development services for companies from capital and cryptocurrency markets.

Schedule your appointment right now to learn more

Blockchain meetup sponsored by Empirica, Wroclaw

Monday June 19th a beautiful sunny day in IT-friendly Wroclaw, tech start-ups and cryptocurrency enthusiast gather together at IT corner Tech meetup, sponsored by Empirica.

The event was planned to focus on key areas of current trends in Blockchain and Ethereum.

The event began with Mr Wojciech Rokosz, Ardeo CEO presentation. The session was dedicated to introduction to the economics of token. Explaining the new changes and updates we are and we will face in our economy with this huge entrance of virtual currencies.

The event later carried on with Mr Marek Kotewicz on introduction to Blockchain, Bitcoin and Ethereum. The session was summarizing the differences between Bitcoin and Ethereum.

The third and last part of the event was conducted with Mr Tomek Drwga, Blockchain meetup organizer, diving deeper into smart contracts and programming ( introduction to Solidity) for Ethereum.

The event ended with open discussion between the audience and speakers, and visitors were served with beverages.

Schedule your appointment right now to learn more

New York Intensive Business Journey | Consensus 2019

During our last visit to New York, we held multiple business meetings with our partners and potential clients, which led to kick-start some new, exciting algo trading projects.

We had been spreading the word about our flagship products – Algorithmic Trading Engine, Liquidity Engine and the newborn baby – Liquidity Analytics Dashboard for crypto markets. Making use of every spare hour, we participated in different industry events connected with crypto trading and blockchain.

You might have met Empirica’s Vice-President and Co-Funder Piotr Stawiński on conferences and meetups such as NYC Crypto Mondays, various Blockchain Week events or Consensus 2019.

Empirica presented ‘ways of implementing Robo-Advisors’ at Fintech Trends

On behalf of Empirica, Hanif Nezhad talked about the different ways Robo Advisors could be implemented and the lessons we have learnt from firms which have digitalized their wealth management operations

He used our Robo-Advisory platform to showcase the different ways possible to apply Robo-Advisors. Although the list of choices firms may have before going Robo is long, he used the major options available, such as model portfolio vs discretionary portfolio management, different ways to perform rebalancing and Empirica’s recommendation engine.

At the end of his presentation he showed how at Empirica we can improve advisor-customer relationship using our built-in house machine learning algorithm for Robo-Advisors.

The event was followed with a panel session where the three speakers discussed variety of topic related to Robo-Advisors such as differences among Robo-Advisors, the Robo-Advisor business in Europe and Poland. The panelists also talked about ETFs and why Robo-Advisors are a big fan of them. After the panel audiences could approach the speakers and ask their questions. The event was concluded with networking session.

Empirica was a proud sponsor of the event.

Empirica is a Wrocław-based company that supports many local IT initiatives. Empirica is offering solutions such as an Quant Trading Software implemented by major institutional investors in Poland, market making software, portfolio management system framework, crypto trading bots and trading software development for companies from capital and cryptocurrency markets.

Empirica will take part in Robo-Advisors – Open Mic Night run by Fintech Trends

On behalf of Empirica, Hanif Nezhad will talk about the different ways Robo Advisors can be implemented and the lessons we have learnt from firms which have digitalized their wealth management operations.

We are also a proud sponsor of the event, so make sure you come and visit us there.

Organizations will be provided free entry, but in order to make sure you will have a seat – register here.

About us

Empirica is a Wrocław-based company that supports many local IT initiatives. Empirica is offering solutions such as Automated Cryptocurrency Trading Software implemented by major institutional investors in Poland, market making software, portfolio management system framework, crypto trading bots and trading software development for companies from capital and cryptocurrency markets.

Congratulations to Swissborg for launching successfull ICO on our software

Nothing pleases us more than the success of our partners – especially when we were able to participate in it. The Swiss provider of wealth management services has just started with its Initial Coin Offering. The campaign will end on January 10th, and one of its ingredients is the platform, which we had the opportunity to help building. Why is this solution better than standard ICO dedicated portals? Because it is completely optimized for the needs of our client and it has an excellent UX tailored interface.

To meet these requirements Empirica delegated the best specialists experienced in fintech projects. However, the functionality of this solution can be best assessed by simply using it. For more details visit Swissborg.com In the meantime we keep our fingers cross for the success in raising a whole sum.

About us

Empirica is a Wrocław-based company that supports many local IT initiatives. Empirica is offering solutions such as Quantitative Trading Software implemented by major institutional investors in Poland, market making bot, robo advisory software framework, crypto trading bots and trading software development for companies from capital and cryptocurrency markets.

Schedule your appointment right now to learn more

CEO of Empirica, was among keynote speakers at the CFA Investment Summit

On October 27th, 2017 the CFA Investment Summit, a key event for financial market participants in Poland, took place at the Warsaw Stock Exchange.

The event was organized by CFA Society Poland. The main media partner was the newspaper “Puls Biznesu“. The conference was divided into a series of lectures and panel sessions with the participation of nearly 250 experts from Poland and abroad.

This year’s event began with the presentation of the results of a survey commissioned by CFA Society Poland. The survey was run on a sample of more than 500 financial professionals and its subject was knowledge of fintech issues.

Its results indicate that, when asked about their knowledge of the use of new technology in the financial industry, only 31% of respondents responded that it was very good or good. The vast majority of respondents (40%) said that they were “neither well nor poorly” acquainted with the topic.

The conference

In the first part of the conference, the speakers focused on what the opportunities and risks the fintech revolution presents, especially for companies and managers dealing with traditional investment advice.

– According to a survey conducted among top experts, they absolutely do not see the threat. Almost 80% think that fintech is not a problem for them, because they are good enough that when conditions change they will adjust and win. On the other hand, for less developed professions that do not require creativity, it is indeed a threat, because these professions will disappear. The ones which stay will be specializations that require creativity, an analytical approach and communication skills – explains Krzysztof Jajuga, President of CFA Society Poland.

The next part of the conference was dedicated to robo-advisory platforms. The panel discussed the difference between fully automated models and hybrid solutions. It was attended by Empirica S.A. CEO Michał Różański, who noted:

–There is space for a whole spectrum of advisors on the market – from traditional to fully automated models. Today, in a rapidly changing world, it is hard to predict how the accents will be distributed. Since now 1 percent of the population uses financial advisory services, there is a problem with supply/the problem lies with the supply, because it pays off for advisors to advise only the richest . This is the space for automated consultancy.

The founder of Empirica believes that the entrance of the generation of millennials in the market, increasingly eager to use AI-based (artificial intelligence) solutions, will especially be the impetus for the development of fully automated advisory platforms, which, using a well-tailored user interface, will allow customers with lesser resources to engage more on the investment market. Which, he added, should lead to its greater democratization.

More (in polish)

About us

Empirica is a trading software company focused on developing the potential that cryptocurrencies bring to financial markets. Empirica is offering solutions such as Cryptocurrency Trading Software used by professional cryptocurrency investors, crypto market makers, robo advisory system, crypto trading bots and trading software development services for companies from capital and cryptocurrency markets.

Schedule your appointment right now to learn more

The biggest market maker in Poland uses Empirica Platform

It’s been two years since Empirica has successfully deployed the full version of Algorithmic Trading Platform for Dom Maklerski Banku Ochrony Środowiska (DM BOS Brokerage House). Since then DM BOS has become the most active market maker on Polish capital market, running its market making and algorithmic trading operations through Empirica’s platform.

With a great pleasure Empirica would like to inform that DM BOS was lately awarded as Polish Capital Market Leader 2016 by Warsaw Stock Exchange (WSE).

The Gala was attended by representatives of the most important capital market institutions: issuers, brokerage houses, banks, investment firms, industry organisations and associations. DM BOS was awarded in following categories:

- for the biggest share of a local market maker in trading in equities on the Main Market in 2016,

- for the biggest share of a market maker in the volume of trade in index options in 2016 on the derivatives market,

- for high quality of the reporting of trades to KDPW_TR in 2016.

– We are very pleased to see, that using our software DM BOS was awarded by WSE in main categories. I would like to sincerely congratulate managers of DM BOS such amazing results for the 2016. Since 2012, when we started our cooperation we are committed to continuously develop and enhance our algorithmic trading platform in order to achieve the highest technical requirements and to satisfy different and changing needs of our customer. I would like to thank DM BOS once again for the opportunity to be a part of their winning market making strategy. – Michal Rozanski, CEO of Empirica

WSE is the biggest securities exchange in Central and Eastern Europe and organises trading on one of the most dynamically growing capital markets in Europe. WSE operates a regulated market of shares and derivative instruments and the alternative stock market NewConnect for growing companies. WSE is developing Catalyst, a market for issuers of corporate and municipal bonds, as well as commodity markets. Since 9 November 2010, GPW is a public company listed on Warsaw Stock Exchange.

About us

Empirica is a trading software company focused on developing the potential that cryptocurrencies bring to financial markets. Empirica is offering solutions such as Algo Trading Platform used by professional cryptocurrency investors, market maker software, robo advisory software, crypto trading bots and trading software development services for companies from capital and cryptocurrency markets.

Schedule your appointment right now to learn more

Who is moving FinTech forward in continental Europe? Thoughts after FinTech Forum on Tour.

By Michal Rozanski, CEO at Empirica.

In the very centre of Canary Wharf, London’s financial district, in a brand new EY building, a very interesting FinTech conference took place – FinTech Forum on Tour. The invitation-only conference targeted the most interesting startups from the investment area (InvestTech) from mainland Europe. The event had representative stakeholders from the entire financial ecosystem. As Efi Pylarinou noted – the regulator, the incumbents, the insurgents, and investors, were all represented.

Empirica was invited to present its flagship product – Algorithmic Trading Platform, which is a tool professional investors use for building, testing and executing of algorithmic strategies. However, it was amazing to see what is happening in other areas of the investment industry. There were a lot of interesting presentations of companies transforming the FinTech industry in the areas of asset and wealth management, social trading and analytics.

The conference was opened with a keynote speech by Anna Wallace from FCA. Anna talked about the mission of FCA’s Innovation Hub; that is to promote innovation and competition in the financial technology field and to ensure that rules and regulations are respected. Whilst listening to Anna it became clear to me what the real advantage of London holds in the race to become the global FinTech capital – London has Wall Street, Silicon Valley and the Government in one place – and what’s most important, they cooperate trying to push things forward in one direction.

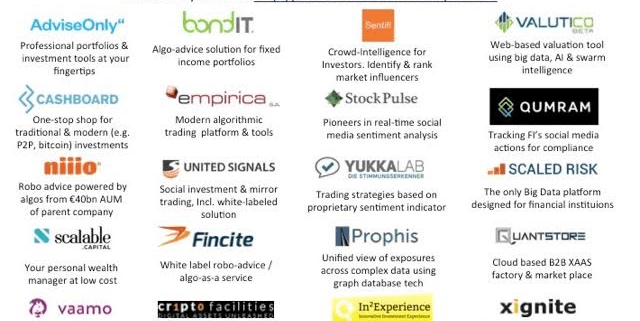

Robo-advisory

A short look at the companies presenting themselves at the event leads to the conclusion that the hottest sector of FinTech right now is robo-advisory. It’s so hot, that one of the panellists noted it’s getting harder and harder to differentiate for robo-advisory startups. On FinTech on Tour this sector was represented by AdviseOnly from Italy, In2experience, Niiio, Vaamo and Fincite – all from Germany. Ralf Heim from Fincite presented an interesting toolkit ‘algo as a service’ and white label robo-advisory solutions. Marko Modsching from niiio revealed the motivation of retail customers, that “they do not want to be rich, they do not want to be poor”. Scalable Capital stressed the role of risk management in its offering of robo advisory services.

Social analysis/Sentiment/ Big Data

The social or sentiment analysis area, keeps growing and gains traction. Every day there’s more data and more trust in the results of backtesting as that data builds up over the years. The social media space is gaining ground. Investment funds as well as FinTech startups are finding new ways to use sentiment data for trading. And, it’s inseparably related with the analysis of huge amounts of data, so technically the systems behind it? are not trivial.

Anders Bally gave an interesting presentation about how to deal with sentiment data and showed how his company Sentifi is identifying and ranking financial market influencers in social channels, and what they discuss.

Sentitrade showed its sentiment engine for opinion mining that is using proprietary sentiment indicator and trend reversal signals. Sentitrade is concentrated on German-speaking markets.

Asset management

From the area of asset management an interesting pitch was given by Cashboard, offering alternative asset classes and preparing now for a huge TV marketing campaign . StockPluse showed how to combine information derived from social networks and base investment decisions on the overall sentiment. United Signals allows for social investing by making it possible to trade by copying transactions of chosen trading gurus with a proven track record, all in an automated way. And, finally BondIT, an Israeli company, presented tools for fixed income portfolio construction, optimization and rebalancing with use of algorithms.

Bitcoin and Blockchain

An interesting remark was given by one of the panelist: ‘we have nearly scratched the surface for what blockchain technology can be applied to in financial industry’. Looking at the latest news reports that are saying that big financial institutions are heavily investing in blockchain startups and their own research in this field, there is definitely something in it.

A company from this sector of FinTech – Crypto Facilities, represented by its CEO Timo Schaefer, showed the functionalities of its bitcoin derivatives trading platform.

Other fields

Hervé Bonazzi, CEO of Scaled Risk, presented its technologically advanced Big Data platform for financial institutions for risk management, compliance, analytics and fraud detection. Using Hadoop under the hood and low latency processing. Ambitious as it sounds.

Analysis of financial data for company valuations, Valutico presented a tool that’s using big data, AI and swarm intelligence. Dorothee Fuhrmann from Prophis Technologies (UK) presented a generic tool for financial institutions to derive value and insights from data, interestingly describing indirect exposures and a hidden transmission mechanism.

Stephen Dubois showed what Xignite (US) has to offer to financial institutions and other FinTech startups in the area of real-time and historical data that is stored in the cloud and accessible by proprietary API.

Qumram, in an energetic presentation delivered by Mathias Wegmueller, described technology for recording online sessions on web, mobile and social channels, allowing for the analysis of user behaviour and strengthening internal security policy.

Conclusion

London is the place to be for FinTech startups. No city in Europe gives such possibilities. Tax deductions for investors. Direct help from the UK regulator FCA. Great choice of incubators and bootcamps for startups. No place gives such a kick. Maybe Silicon Valley is the best place for finding investor for a startup, maybe the Wall Street is the centre of the financial world, but London is the place that combines both the tech and the finance. It has a real chance of becoming the FinTech capital of the world.

About organizators

The people responsible for creating both a great and professional atmosphere at the event were Samarth Shekhar and Michael Mellinghoff. Michael was a great mentor of mine who transformed my pitch from a long and quite boring list of functionalities of our product to something that was bearable for the audience. Michael let me thank you once more for the time and energy you have devoted to Empirica’s pitch!

And because the FinTech scene in our region is not well organized yet, I sincerely advise all FinTech startups from Central and Eastern Europe to attend cyclic events of FinTech Forum in Frankfurt organized by Techfluence professionals!

Read about our Lessons learned from FinTech software projects.

Crypto Liquidity

Reports

Listing on

Technology

Empirica Internationally

Empirica © Copyright 2012-2025

A financial technology company. Crypto market maker and liquidity provider for token projects and exchanges.