AMM – Automated Market Maker – its role and examples

Table of contents

1. What is Automated Market Maker

Automated Market Maker is a smart contract that facilitates transactions on two assets used by decentralized exchanges. In this system, traditional order books with orders from buyers and sellers are replaced by liquidity pools which are the counterparty for the trades. Each trade changes the ratio of assets in the pool and influences the price, which is a function of the assets’ ratio. This simple logic is behind the greatest invention in the crypto space. Assets in the pool are brought by liquidity providers, that are incentivized by the fees from each transaction. Any holder of these two assets can be a liquidity provider.

Check here for details on how we do market making for crypto projects

2. Liquidity Pools

Automated Market Makers are using liquidity pools. Liquidity pools provide the possibility to conduct transactions for the crypto market participants.

The role of the liquidity pool is to:

- allow your users the possibility of trading (buying and selling) the tokens

- facilitate the trading process

- increase the speed of financial exchange

For in-depth look at how liquidity pools work check our other post.

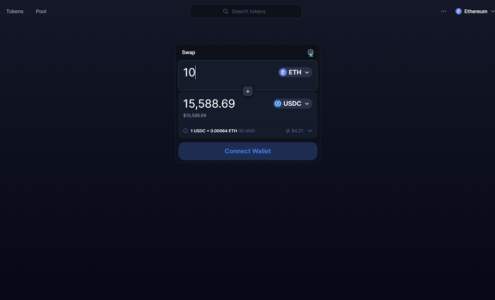

3 Uniswap

Uniswap is a decentralized AMM decentralized exchange for ERC-20 tokens (now working also on other EVM chains like Polygon, Arbitrum, or Optimism), supporting ETH and ERC-20 contracts in a 1:1 ratio.

The main benefit is the flexibility of the token launch, meaning that anybody can launch the token on Uniswap without any additional fees.

Uniswap has now over $4.7B in TVL.

Uniswap V2 vs Uniswap V3 liquidity pools

During the last 2 years, the most broadly recognized DeFi protocol (Uniswap) has been improving its model of liquidity pools (and trying to find the product market fit).

Firstly, in 2020, the V2 model was introduced, starting the era of decentralized finance.

V2 was about creating liquidity pools for any ERC 20 tokens (especially for the tokens unavailable on other crypto exchanges).

One year later, in May 2021, the launch of the V3 model occurred. V3 provided much better capital efficiency than V2, meaning that the liquidity can be more concentrated, and could be used efficiently also for stablecoin trading, where liquidity concentrated in a certain price range is a key feature.

After 2 years, it turned out that V3 completely dominated the trading value in USD, while V2 was leading in terms of transaction quantity metric.

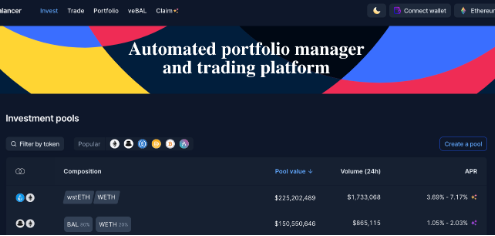

4 Balancer

Balancer is a decentralized crypto liquidity pool, also serving as a price sensor and non-custodial portfolio manager.

The main benefit here is the possibility of creating multiple pooling options, meaning you can create pools with more than two digital assets in a single pool.

What’s interesting is that users can create various types of pools (private, public, and smart ones).

Balancer is also called heaven for DeFi farmers because any pool for any token can be found there, and the APRs are also higher than on competitive platforms.

The whole idea of the protocol is to provide an automated market maker solution, running on the pools provided by the users.

Balancer was created in 2018 and its TVL has grown to over $1.6B.

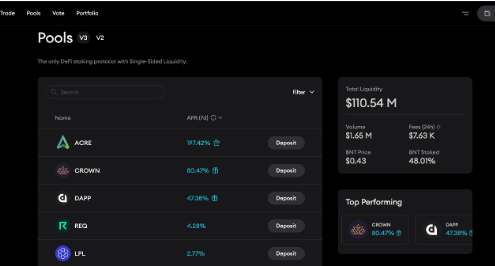

5 Bancor

Bancor is one of the OG Ethereum-based DeFi platforms that uses an algorithmic market-making formula for leveraging pooled liquidity.

The Bancor Relay liquidity pools resolve the concerns of volatility in the liquidity.

It’s similar to Uniswap or Balancer, but focuses on low-cap tokens that are not listed on exchanges. Sometimes, there is a situation when the transaction cost can be unreasonable, and that’s where the main benefit of Bancor appears.

They use a technology solution called “smart token”, allowing crypto traders to conduct buy and sell transactions on low-cap tokens with fractional fees.

The main downside called out by the “bitcoinchaser” blogger is the low liquidity of Bancor in the situation of a bank run (a massive sell-off), when the reserves could be potentially drained after a 20% price move.

The TVL of Bancor fluctuates around $115M.

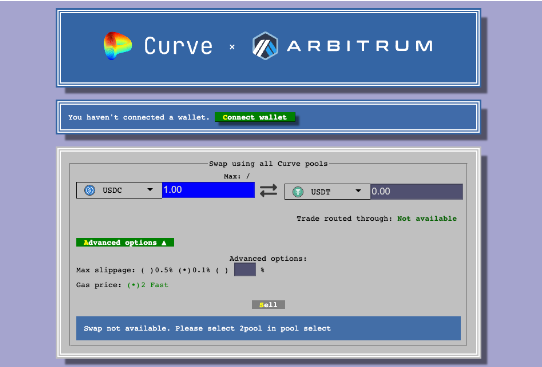

6 Curve Finance

Curve Finance is one of the protocols born on top of the DeFi summer, mainly known for its innovative “ve” tokenomics, and protocols built on top of Curve.

Not only that, but also it’s an Ethereum-based (and expanding to other chains) decentralized crypto liquidity pool made for stablecoins’ trading with low slippage.

The reduced slippage is the main benefit here. Curve delivers pools for 7 most popular stablecoins on different EVM networks, allowing traders to transact stablecoins (including DAI, USDT, USDC, BUSD, or TUSD) on Ethereum, Arbitrum, Polygon, or Optimism.

The pools provide a mechanism where the users can exchange vast amounts of stablecoins without affecting the stablecoin’s dollar peg and without the need to find the counterparty of the transaction, because the exchange mechanism is running on liquidity pools, incentivized by the $CRV token.

The current Curve’s TVL is now around $6.3B, making Curve one of the biggest DeFi protocols that ever existed.

Bottom Line

Thanks for your time! If you found this interesting, share the article on Twitter and show your friends that web3 is a great space.

See you in the next article!

Check here for details on how we build organic liquidity for crypto projects