Token liquidity – how can cryptocurrency projects handle it right?

23 August 2022

Coin listing on a well-established centralized or decentralized platform proves to be one of the major key points to look for from the community and investor’s point of view. And when your project gets listed, suddenly the liquidity of your token becomes a significant issue.

What is liquidity in token?

Liquidity is the measure of how easily you can convert an asset into cash or another asset.

A frequent question is – how to measure token liquidity? When do we know that coin liquidity is good or weak? Best measures are expressed by a number. Let us see how coin liquidity is measured for the crypto markets.

Where can I find token liquidity?

How is liquidity token calculated? The price-tracking websites for crypto assets like CoinMarketCap or CoinGecko have defined their own liquidity metrics for token markets. They allow investors to understand and compare the difference in liquidity across different markets.

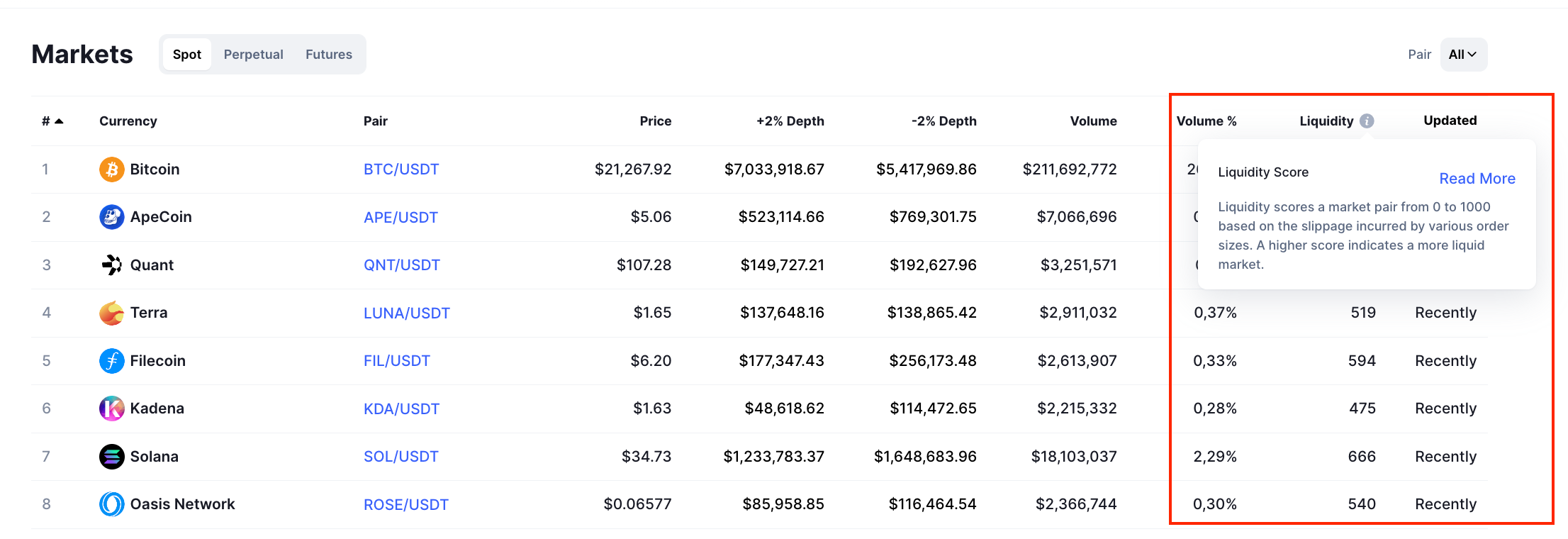

CoinMarketCap’s Liquidity Score

CoinMarketCap uses a Liquidity Score metric, a value from 0 to 1000 based on the slippage incurred by various order sizes. Slippage is the difference between the expected price of an order and the price when the order actually executes.

When executing trades, the most liquid markets have the least slippage. CoinMarketCap’s Liquidity Score calculated for a market pair is based on how much slippage a trader would incur on a range of orders if the trades were executed immediately.

A Liquidity Score of 1000 means that the market has a very low slippage for orders up to $200,000 in size. On the other hand, a Liquidity Score of 0 means that the order books have less than $100 in total value on either the buy or sell side — an example of very illiquid markets.

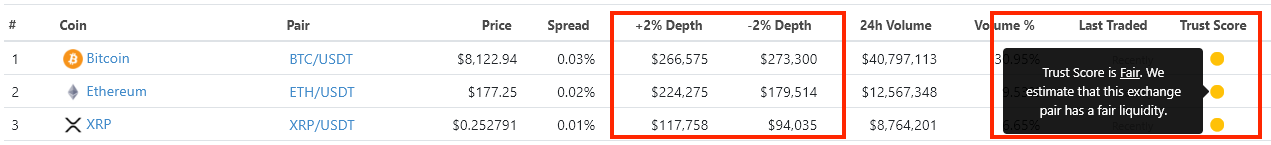

CoinGecko’s measures

CoinGecko uses a metric called Trust Score, calculated using a combination of Web traffic stats, order book spread & ±2% depth, overall trading volume, and trade frequency. For simplicity, the metric is displayed in colors green, yellow, red, or none under the “Trust Score” column.

Such liquidity metrics are much more difficult to manipulate than volume-based metrics, which is quite important in the crypto scene. Before CoinMarketCap and CoinGecko introduced the new measures (Liquidity Score and Trust Score), they mainly ranked the coins based on reported volumes, which in many cases were faked by manipulating the markets.

Empirica token liquidity ranking on Uniswap v3

We are an active market maker on DEXes and gather tones of data from the most popular one – Uniswap v3. We’ve published token liquidity reports including crucial metrics such as slippage and market depth. We also publish extended liquidity analyzes for selected tokens from our ranking. You can learn what they actually do that they achieve such good liquidity.

Why is token liquidity important?

Situation with low liquidity problems: When startup projects list their tokens on cryptocurrency platforms without much plan, there is usually very little activity in their markets (trading pairs). The spreads are large (a couple of percent). And when an investor tries buying or selling a bit of the token, it leads to significant price swings. That all could discourage investors from trading such an asset. That is why well-managed cryptocurrency projects reserve some budget to hire one or more market makers.

If your token is listed on an exchange but has poor liquidity, you are risking even a delisting process of your token.

How does a liquidity provider improve the coin liquidity on an exchange? Let us analyze that in detail, separately for centralized exchanges and decentralized platforms.

Building liquidity on centralized platforms

On centralized exchanges, like in traditional finance, liquidity providers submit limit orders continuously to the markets. They quote bid and ask prices 24/7 (almost – in practice, a liquidity provider usually commits to 90%+ uptime). In the market making contracts, token projects define the expected liquidity depth per market to be maintained by the cryptocurrency liquidity provider. Usually, a liquidity provider utilizes market making strategies as the heart of their operations.

Building liquidity on decentralized exchanges

In the DeFi ecosystem, market makers are starting to also support liquidity on decentralized exchanges. Based on a different concept, DEXes use a deterministic pricing algorithm called an automated market maker (AMM), which utilizes pools of tokens (liquidity pools) locked in smart contracts called liquidity pools.

Digital assets are usually listed on multiple platforms. When the price of a crypto asset in the liquidity pool of a given DEX deviates from the global market price, arbitrageurs will come in and push the price back to the global market price.

Market makers on DEXes provide liquidity to the liquidity pools. The protocol provides liquidity providers with a percentage of the fees for transactions performed by pools.

How to manage liquidity on DEXes?

Piotr explains the difference between passive and active management of concentrated liquidity on DEX platforms based on examples from the most popular one: Uniswap V3. He demonstrates how to manage token liquidity with efficient use of capital achieving the same results with less burden on token project’s treasury.

Enjoy the video!

FAQ

How do LP tokens (Liquidity Pool tokens) work?

Many DeFi platforms have introduced liquidity pool tokens (LP tokens), sometimes also called liquidity provider tokens (as they are only for liquidity providers), as an incentive for funding the liquidity pools. They represent a receipt, allowing you to claim your original stake and interest earned. LP tokens work as a crypto liquidity provider's share of a pool in a decentralized exchange. The crypto liquidity provider remains entirely in control of the token.

What is a liquidity pool?

A crypto liquidity pool is a smart contract, with crypto tokens locked for the purpose of providing liquidity.

What is a liquid asset?

Liquid assets are assets that can easily be exchanged for cash or another asset.

What is an Automated Market Maker (AMM)?

Automated market maker (AMM) is a tool used in decentralized exchanges, that utilize so-called liquidity pools, which store coins or tokens that are locked in a smart contract. Liquidity pools are used to facilitate trades between those assets. Instead of a traditional model of buyer and seller market, a liquidity pool is a counterparty for the trades.

What is liquidity mining?

Liquidity mining is a strategy in which participants within a DeFi ecosystem contribute their crypto assets to make it easy for others to trade within a platform. In return, the participants are rewarded with a share of the platform's transaction fees or newly issued tokens.

What does DeFi mean?

It is a shortcut for decentralized finance.

What is a bid-ask spread?

A bid-ask spread represents the difference between the bid — the price buyers are willing to pay — and the ask, which is the price sellers are willing to accept to trade a financial asset. The wider the bid-ask spread, the more volatile and less liquid that instrument is. Investors may not execute as often when there is a large spread.

What is yield farming?

Yield farming refers to lending or staking cryptocurrency in exchange for interest and other rewards. Yield farmers measure their returns in terms of annual percentage yields (APY).

What is staking?

With crypto staking, investors earn funds by holding coins or tokens in their wallets. On Proof of Stake blockchains, rewards based on minting new coins are distributed to those who stake funds according to the size of their holdings.

What does it mean that liquidity is locked?

Liquidity is locked by renouncing the ownership of liquidity pool tokens (LP tokens) for a fixed time period, by sending them to a time-lock smart contract. Without ownership of LP tokens, developers cannot get liquidity pool funds back.

We are market makers and liquidity providers on centralized and decentralized platforms

CEXes rely on centralized order books, which provide a different trading environment compared to AMMs. We can efficiently manage orders, respond to market depth, and adapt to changes in trading volumes and liquidity on centralised platform.

DEX exchanges operate differently from their centralized counterparts due to the presence of Automated Market Makers. While many tokens try to provide liquidity to their pools on their own, it often results in inefficient capital usage or considerable losses. We are also market makers and liquidity providers on DEXes and can ensure continuous liquidity provision to all your pools maintaining constant level of slippage.