Cryptohopper – Technical Review 2019

There is quite a hot market for cryptocurrency trading platforms and algorithmic trading bots. New crypto traders and active traders from capital markets are pouring in funds into algorithmic strategies and bots to make the most out of the constant opportunistic cryptocurrency fluctuation. On the other hand trading platform, providers and investment bots are tailoring their strategies to be tuned well to different scenarios depending on the type of events occurring within the market.

Due to the expansion of development from these trading bots and their adaptability to different events, the process of choosing one has become quite challenging, even for those with technical and trading background, hence at Empirica, we decided to bring knowledge about professional crypto trading bots to interested readers and traders and our selected bot for this article is Cryptohopper.

In this review, we will cover relative features included in Cryptohopper trading platform. We analyze ways that traders can utilize Cryptohopper for their trades. We also take a look at their tool from a technical point of view (our team at Empirica has been focused on the institutional algorithmic trading platform and market making algorithms for almost 10 years). Later in the review, we will also take a look at options we believe Cryptohopper lacks. But first and foremost:

What is Cryptohopper?

Cryptohopper is an retail algorithmic trading platform with a series of configurable trading features (more on professional algorithmic trading platform). Cryptohopper’s platform is shaped around 5 key elements, which each have been developed further to meet the needs of traders. The 5 key elements are:

- Mirror trading

This feature allows investors to copy the trades of experienced and successful forex investors. Strategies are available through a marketplace, some free and some paid. - Paper trading

A simulated trading practice to assess trading algorithms with real and live data. - Strategy designer

A technical indicator assembler which lets traders design their strategies using the listed indicators. There are currently somewhere around 130 technical indicators provided by Cryptohopper. - Algorithmic trading

An automated way of executing trading algorithms with a specified set of configuration. - Trailing stop

It’s a feature designed to stop strategies to operate if a defined trigger has been pulled.

Which exchanges are supported by Cryptohopper?

There are in total of 10 exchanges that are supported by Cryptohopper. Exchanges are KuCoin, Bitvavo, Binance, Coinbase pro, Bitterex, Poloniex, Kraken, Huobi, Bitfinex and Binance.US.

How can I trade with Cryptohopper?

Depending on your sophistication level and trading knowledge, Traders can utilize Cryptohopper platform to their use. There are two bots, the market-making and Arbitrage bots and there are also strategies that can be used to select a set of indicators to form a strategy.

Market Making Bot

The market making bot is designed for retail investors (check market making bot for professional users). It is designed to perform liquidity provision to the market of traders’ choice. The market making bot is a configurable algorithm that executes buy and/or sell (take and/or make) by placing a layered limit of buy and sell orders.

To initiate using the market making bot, traders must go through the preliminary configurations. Starts with choosing an exchange and setting up the API keys. Even using the API the fund still will be located in the exchange and in order to trade on the exchange, traders need to generate an API key and then connect that to their Cryptohopper account.

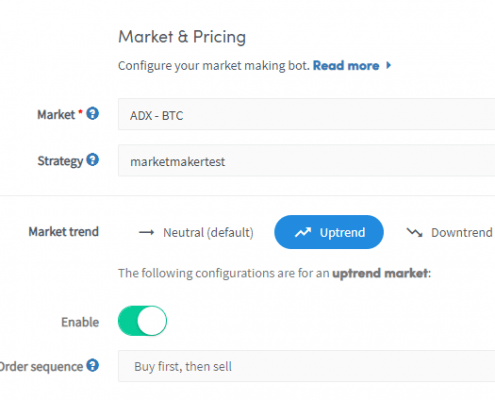

After the initial configuration, there is also a set of more advanced Market Making configuration. Market and Pricing is the second stage of Market Making setup at Cryptohopper. This stage includes configuration of the market and which pair trader is interested in. Then moving on to the strategy setup with market trends. Market trends are either uptrend, downtrend or it could stay as neutral. Additionally, the order sequence of buying and selling with a given sequence, the order layer which represents the tiered buy and sell orders that are going to be placed and the moving on to the amount constraints within layers (e.g. buy amount, higher ask and percentage lower bid).

The Cryptohopper Market Making bot is also equipped with an “Auto-cancel” functionality which based on the configuration determines when to open and close positions. There is also a time limit to trigger the cancel on the bot. Seemingly the most important feature of the Auto Cancel is the Cancel on the trend, which enables auto cancelling on the bot when the marker changes to a direction e.g. from neutral to a downtrend or from neutral to uptrend and etc. Cancellation on the bot could also be triggered with percentage change, this only happens if the market has a certain specified percentage change or within a given period. The auto-cancel feature also works with the depth limit, which Traders can set from a minimum of 1 to a maximum of 500. Additionally, Traders that are interested in Cryptohopper Market Making bot can set their “Stop-loss” settings. Stop-loss can be triggered in the event of a turn in the market.

Cryptohopper market making bot also provides a revert and backlog feature, where it can move all the failed orders to the Traders’ backlog. Traders can also revert all their cancelled orders from the backlog if Traders decide to revert back a failed market maker orders and re-execute the orders. There are many more settings on reverting back orders that can be automated with configuration, to name of the settings, only revert if it will lead to a profit, or revert/not revert with market trends such as neutral trend, downtrend or uptrend.

In order to slow down the market making bot, Cryptohopper introduced the cool down feature, which the bots cooldowns by removing the order after a certain time has passed.

Cryptohopper has designed a dashboard with some widgets for Traders to monitor the market making bot in action. There is a trading view widget which is a visual representation of the current prices.

Among other widgets available on the Cryptohopper dashboard, there is the order book visualizations with the possibility of manual Market Making which enables buying and selling to be connected to each other and will input that order into the Market Making bot logs.

Cryptohoppe also has created an inventory for all failed trades to be stored in a place called backlog. In order for Traders to be able to use the Cryptohopper Market Making bot they need to be subscribed to the “hero hopper Pro” package, which costs a monthly subscription fee of 99$.

The Arbitrage bot:

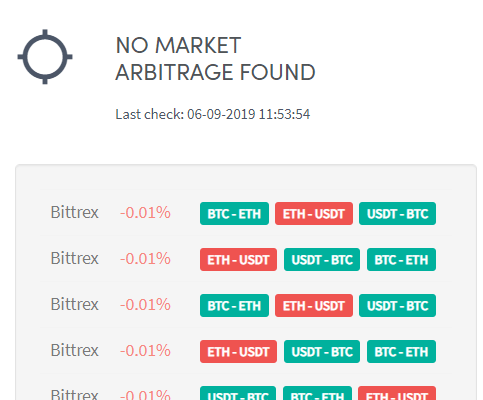

The Arbitrage bot of Cryptohopper is designed to capitalize from changes across different markets. The bot allows to trade discrepancies in the market, taking advantage in market price between the same pairs on different exchanges.

Just like the market making bot, the Arbitrage bot also requires a pre-setup procedure to get going with the bot. The procedure starts with setting up the maximum open time of all buy orders, which determined the number of minutes a buy order remains open before the order is cancelled. Following that, there is the maximum open time of all sell orders which does the same thing but for all sell orders.

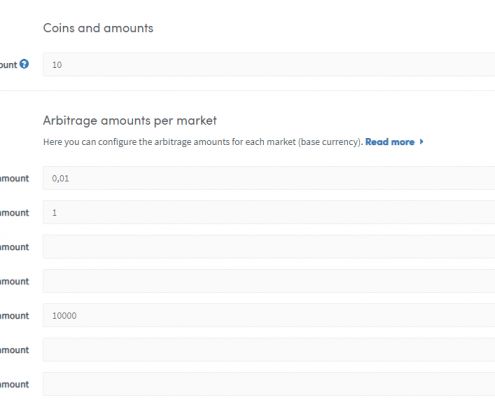

The setting up procedure then takes traders to exchange setting, where traders should specify two exchanges that would like to perform their arbitrage. Afterwards, they will set the percentage sell amount, which it should use to create the amounts which are being traded and then the Arbitrage amount per market which how much of trade at a time should take place.

In case interested trader would like to utilize exchange specific configuration, they can set minimum profit that they would like arbitrage with. Additionally, there are options to have the maximum open time of the Arbitrage. Traders are also given the possibility to simultaneous arbitrages which determine the maximum number of simultaneous or concurrent arbitrages. Furthermore, they set rate on buy and sells which specify the amount the Arbitrage should check.

The Arbitrage dashboard also includes a backlog where all failed trades will be stored. The dashboard also has the latest Arbitrage trades that were both successful and failed. There are also other widgets inside the Arbitrage dashboard, e.g. exchange arbitrage dashboard results, the last five trades and market Arbitrage results.

Strategies:

Traders using Cryptohopper platform could create a trading strategy with a collection of indicators they have selected. These are the indicators to buy and sell trades. Cryptohopper has created a strategy designer feature where traders create and custom their strategies. There are three ways trades can utilize a strategy. First is to use Market Strategies, these are strategies bought on the Marketplace (we cover features of Marketplace later in this article). Strategies bought from Marketplace which could also be automatically be updated every time the seller of the strategy makes changes on the strategy. Second is built-in strategies, Cyrptohopper offers a set of built-in strategies that are offered free of charge. These are rather basic strategies such as uptrend strategies, buy the dip strategies, Bollinger strategies and etc. Third and last is My strategies, these are custom made strategies that traders built.

Strategy designer:

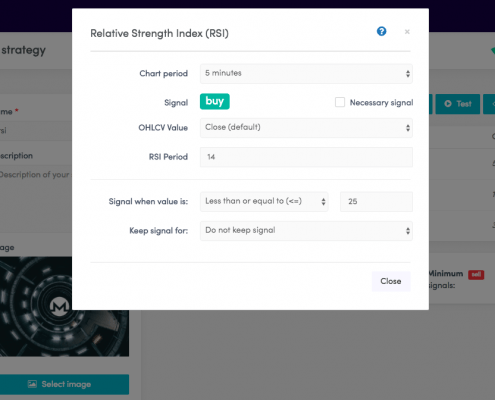

Strategy designer is a place where traders can personalize their technical analysis setting. There are given a set of indicators where traders can find and configure a wide selection of trading indicators. Traders on cryptohopper can decide on the chart period, buy and sell signals and candle period when selecting an indicator. With candle patterns, traders can directly respond to price movements from the chart data of an exchange.

Furthermore, traders can design their strategies by adding a JSON code, this section is designed for more technical and programmer traders. These traders could also modify existing strategies. Once strategies are configured and up and running, Cryptohopper strategy dashboard allows traders to monitor their strategies.

Cryptohopper Marketplace:

The marketplace is a section within the strategy creation process. This unit is designed solely for social and mirror trading. This is where traders with a usually lower level of experience and knowledge in trading can browse already created strategies and use it for their funds to invest with.

There is a set of strategies and templates available in the marketplace. Each template and strategy has a corresponding base-currency and exchange. Therefore templates can be chosen based on traders preferences. Additionally, all templates have information about their ratings, total downloads, modifications and recentness.

The marketplace also consists of Signalers. All signals in the marketplace correspond to an exchange. A trader can configure their trading using only signals. The Signal configuration could limit orders. The setting also allows traders to take profit with a given percentage set.

Strategy statistics:

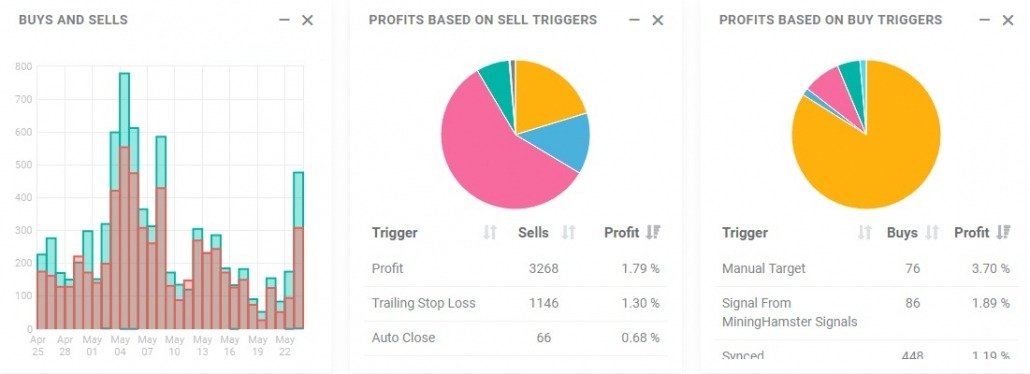

Cryptohopper provides traders with a set of statistics in order for traders to be able to monitor the performance of their strategies and trades. There is a variety of ways provided in the statistics dashboard to see how trades and strategies are performing.

The time period for all buy and sell order, allocation of funds based on currency, open positions and base currency reserved. Traders can view their profit stats basing on currency invested on, base currency returns, the base currency gained/lost in current positions and trading fees paid.

Profit based on sell triggers is another statistic available for traders to monitor profit related to percentage profit, trailing stop loss and auto close within time. Traders can also view profits based on buy triggers that we generated by strategies, signalers, trailing stop buy.

Cryptohopper Academy

For traders who would like to be familiar with Cryptohopper as a trading platform, there is a tutorial-like instruction supported by Cryptohopper itself and other instructors can also use this academy portal to provide education knowledge to interested traders.

Our take:

Cryptohopper has done a decent job working out a tool that traders would feel comfortable doing their trades. We really liked the interface and how they have designed a user journey that would fit a different type of traders with different level of expertise. The wording in the platform is well explanatory and hints around important features. Though, as a solution provider for professional crypto market makers, we believe the assessment of market trends are done manually by users and very sensitive to human error. The market making bot has a low ability to manage more market at once and needs of content human supervision.

Check our take on how trading bots for professional crypocurrency traders are build and designed.

Read reviews on follwing bot platforms: